Advertisement|Remove ads.

BDL Revenue Doubles But Stock Dips: SEBI RA Sees Early Stages Of Long-term Uptrend

Shares of Bharat Dynamics (BDL) fell nearly 2% on Wednesday despite a 100% revenue jump in the March quarter, as margin pressure and a dip in net profits weighed on investor sentiment.

But SEBI-registered analyst Vikash Bagaria believes that BDL is in the early phase of a significant multi-month to multi-year uptrend, supported by strong price action, macro tailwinds, and institutional volumes.

On the technical charts, the stock has seen a fresh bullish crossover in its MACD, while the Relative Strength Index (RSI) continues to rise, showing strength without entering the overbought territory.

Trading volumes have surged to their highest in months, indicating potential institutional entry.

Bagaria likes BDL as a strategic public-sector defense company as the nation intensifies its push for defense exports and self-reliance.

BDL’s technical setup is compelling, with clean breakout above key resistance levels and momentum.

From a strategic investment perspective, he sees BDL as a high-potential defense stock for long-term portfolios, especially on dips toward ₹1,650 or ₹1,700.

For those seeking value, a strong buy zone has been identified at ₹1,170 – ₹1,248. Long-term price targets are set at ₹2,250, ₹2,700 and ₹3,160, while a weekly close above ₹1,500 is seen as a prudent stop loss for positional trades.

On the earnings front, net profit dipped 6% to 272 crore, but revenues rose 108% to 1,777 crore. Analysts remain optimistic due to the company's robust order book worth 22,800 crore.

Nuvama Institutional Equities has raised its target price by 36% to 2,250.

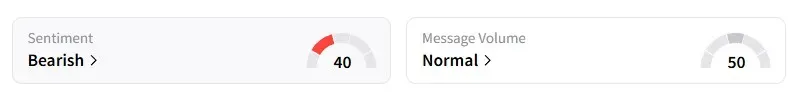

On Stocktwits, however, data shows that retail sentiment turned ‘bearish’ last week.

BDL shares have gained 71% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)