Advertisement|Remove ads.

BEL Strengthens Defense Portfolio With Third Big Order In Weeks

- Bharat Electronics secured a ₹633 crore contract from Cochin Shipyard.

- Analysts flag a technical breakout above ₹436, potentially opening the path to ₹454–₹475.

- Retail sentiment remains cautious despite a strong 44% YTD gain.

Shares of Bharat Electronics (BEL) edged up 1% on Thursday after the company secured a ₹633 crore order from Cochin Shipyard. The contract covers a wide array of defense tech, including sensors, weapon systems, fire control mechanisms, and communication equipment.

This marks BEL’s third significant order in recent weeks, following ₹592 crore and ₹712 crore deals in September and October, respectively.

According to SEBI-registered analyst A&Y Market Research, the consistent inflow of high-value contracts underscores BEL’s growing dominance in India’s defense electronics space and its pivotal role in naval modernization.

They believe that with a robust order book and strong momentum, BEL remains a stock to watch in the defense sector.

BEL is India’s largest defense electronics company, with an order book of ₹74,800 crore.

BEL: Technical view

A&Y Market Research said that a breakout above ₹436 could open the path toward ₹454–₹475 in the short term. However, a close below ₹408 would weaken the momentum for BEL stock.

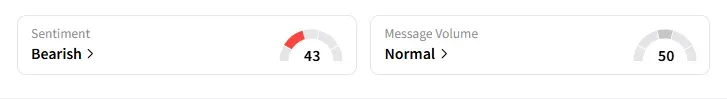

BEL: What is the retail mood on Stocktwits?

Data on Stocktwits showed that retail sentiment has been ‘bearish’ for a week on this counter.

Indian defense stocks have had a stellar run in 2025, with BEL shares surging 44% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229015958_jpg_095394ad49.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_BX_resized_blackstone_jpg_1a169d1a1c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)