Advertisement|Remove ads.

Michael Saylor Hints At ‘Big Orange’ Bitcoin Buy As MSTR’s ‘Ironic’ $250 Million Bet Swells To $60 Billion

- Saylor brought out the “orange” signal over the weekend, indicating that another sizeable Bitcoin buy may be on the cards for Monday.

- The Strategy executive chairman has been using “orange” and “green” signals to indicate whether the company has added to its dollar reserve or Bitcoin reserve over the past week.

- Retail sentiment around MSTR’s stock on Stocktwits remained in “extremely bullish” territory, driven in part by Wells Fargo’s Bitcoin ETF buy on Friday.

Strategy’s (MSTR) Michael Saylor indicated that a sizeable Bitcoin buy may be coming on Monday, as the crypto market continues to trade range-bound.

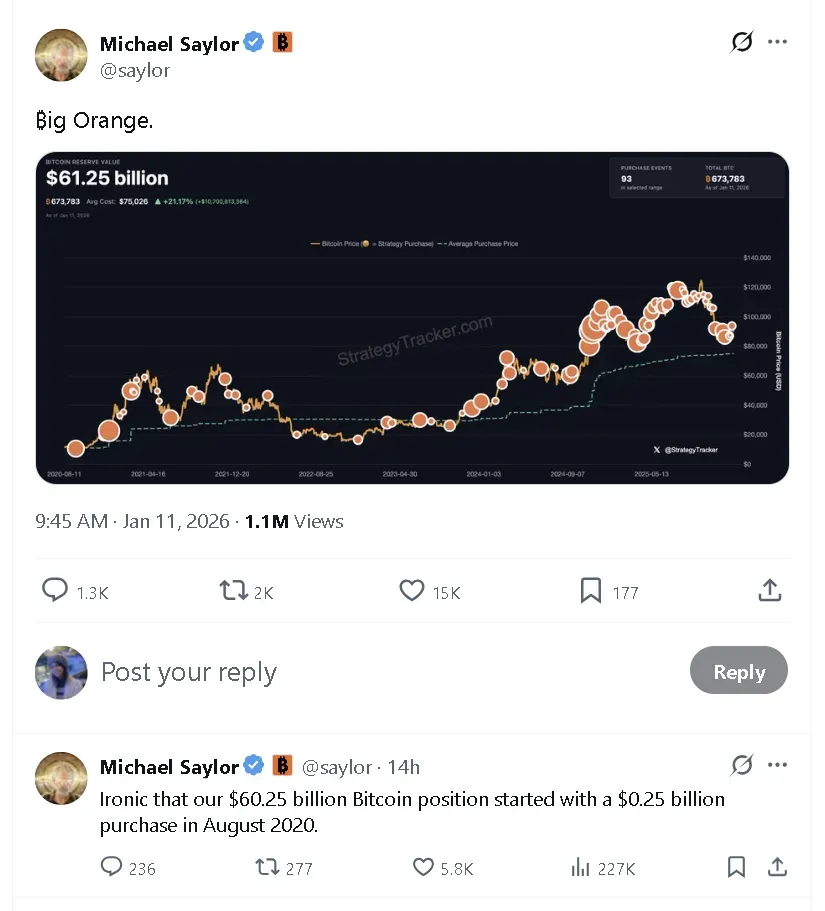

“Big Orange,” he wrote in a post on X on Sunday. MSTR’s executive chairman has been using “orange” and “green” signals to indicate the company’s purchases over the past week, usually before the official announcement, before the market opens on Monday.

“Ironic that our $60.25 billion Bitcoin position started with a $0.25 billion purchase in August 2020,” he added. MSTR currently holds 673,673 Bitcoin in its coffers, valued at around $60 billion. Its recently set up USD Reserve had $2.25 billion.

Saylor Signals Another Bitcoin Move

MSTR’s stock edged 0.27% higher in pre-market trade on Monday after a drop of 5.77% on Friday on weakness in Bitcoin (BTC). On Monday morning, Bitcoin’s price edged lower after a momentary recovery on Sunday following news of President Donald Trump’s subpoena against Federal Reserve Chair Jerome Powell, and the price of gold hit another record high.

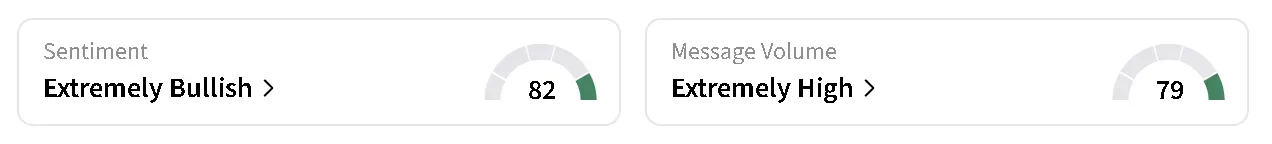

On Stocktwits, retail sentiment around MSTR’s stock remained in ‘extremely bullish’ territory over the past day, with chatter at ‘extremely high’ levels.

What’s Driving The Bullish Sentiment Around MSTR Stock?

A part of the renewed optimism around Bitcoin’s proxy came from broader institutional interest in its treasury asset. Many users on the platform were bullish on MSTR after Wells Fargo (WFC) announced on Friday that it had bought $383 million worth of Bitcoin ETFs through advisory accounts.

WFC’s stock was flat in pre-market trade after edging 0.37% higher on Friday. Retail sentiment around the U.S. bank improved to ‘neutral’ from ‘bearish’ over the past day. Chatter remained at ‘high’ levels.

Another user on Stocktwits said they hope that the momentum behind MSTR’s stock doesn’t fade by the time the market opens.

MSTR’s stock has gained 1.7% so far this year but is down over 50% in the past 12 months.

Editor’s note: This story has been updated to clarify that the reported Bitcoin ETF holdings reflect client purchases made through Wells Fargo advisory accounts.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Jerome Powell Says Trump’s Criminal Threats Are ‘Pretexts’ To Undermine Fed Independence

/filters:format(webp)https://news.stocktwits-cdn.com/large_blue_owl_capital_jpg_4d9954c2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553061_jpg_699278f844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)