Advertisement|Remove ads.

Warren Buffett’s Big Bank Of America Sell-Off Approaches $7B Mark: Retail Finally Turns Bearish

Warren Buffett-owned Berkshire Hathaway’s (BRK.A) (BRK.B) total sales of Bank of America (BAC) stock since mid-July approached $7 billion, according to the firm's latest disclosure. Shares of the lender were down nearly 3% on Friday.

Berkshire’s SEC filing shows it offloaded more than 18.74 million shares of the lender over Tuesday, Wednesday and Thursday last week, worth about $760 million. The sale was conducted at prices ranging from $40.2837 to $40.6595 apiece.

Following the transaction, Berkshire still remains the largest shareholder of Bank of America and holds over 863 million shares of the lender valued at nearly $34 billion.

Last week, Berkshire sold over 21 million shares of the bank over three days. Berkshire offloaded the shares at prices ranging between $39.9485 and $40.6117. Prior to that, the firm sold over 24.66 million shares of the lender at prices ranging between $39.7504 and $39.8692 apiece, raising over $981 million between Aug. 23 and Aug. 27.

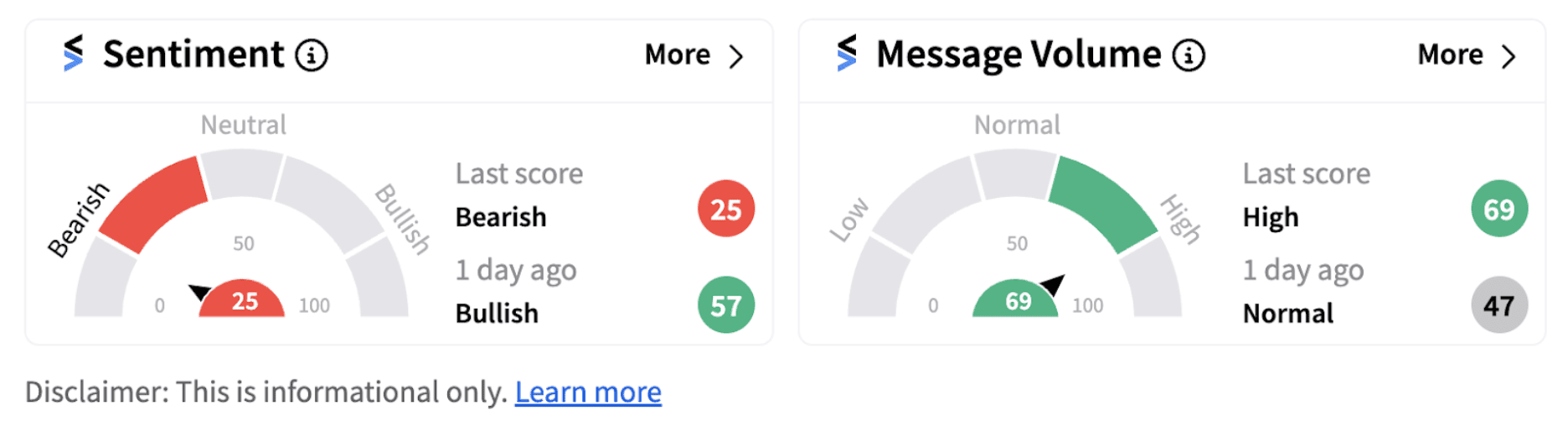

Berkshire has been steadily selling Bank of America stock since mid-July, but retail investors on Stocktwits had remained unfazed until now. On Friday, sentiment shifted sharply, dipping into ‘bearish’ territory (25/100) from ‘bullish’ the day before, with message volumes running high.

Bearish followers of the bank expect the stock to hit $33 soon.

Regardless of the investor sentiment, Bank of America stock has shown significant resilience in the face of such intense selling by a major institutional investor. The stock is up over 15% on a year-to-date basis and has returned over 38% in the last one year.

Investors had reason to cheer as the lender reported a decent second quarter with revenue coming in at $25.4 billion, topping an estimate of $25.22 billion. Earnings per share came in at $0.83 versus an estimated $0.80. The bank’s net interest income (NII), the difference between interest earned and interest expended, fell 3% to $13.7 billion as higher deposit costs more than offset higher asset yields and modest loan growth.

Going forward, investors will be keenly tracking how much more stake will Berkshire Hathaway offload in the coming times.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264976085_jpg_5ac49235ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_newsmax_resized_jpg_3a813181b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)