Advertisement|Remove ads.

Berkshire Hathaway Still A Long-Term Buy For Retail Traders Despite Warren Buffett Exit: Stocktwits Poll

Berkshire Hathaway’s Class-A (BRK.A) stock fell 4.9% on Monday after Warren Buffett surprised Wall Street by announcing his intention to step down as CEO by the end of the year.

However, the conglomerate’s shares rose 2.3% in extended trading.

Berkshire’s board voted to keep Buffett as chairman and appoint insider Greg Abel as president and CEO beginning Jan. 1, 2026.

Buffett had named Abel, the head of Berkshire Energy, as the CEO-designate in May 2021.

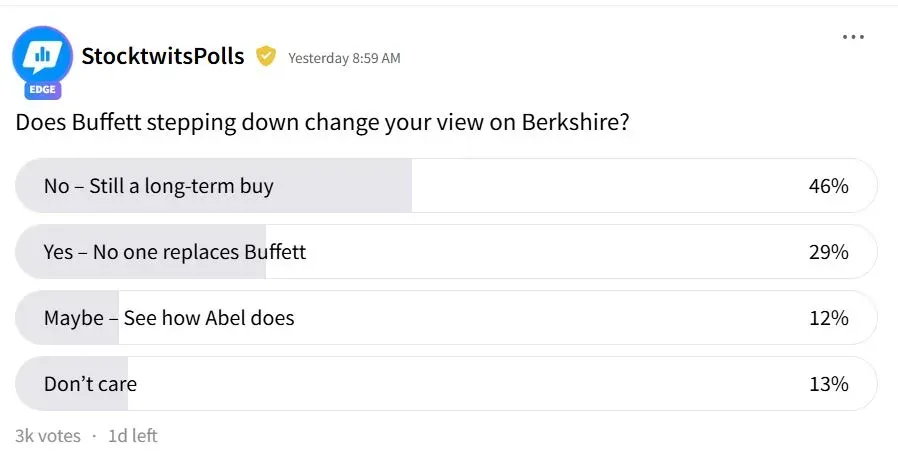

According to a Stocktwits poll, 46% of the respondents said Berkshire remains a long-term “buy” despite the CEO change. While 29% said no one can replace Buffett, 13% said they would wait and see how the company performs under Abel.

Retail sentiment on the stock was “extremely bullish.”

One retail trader said Buffett had plenty of time to choose a successor.

While another user said that while Abel is a good candidate, Berkshire’s insurance business Vice Chairman, Ajit Jain, would have been a more “proven and trustworthy” name.

Abel, born in Edmonton, Alberta, began his professional career at PricewaterhouseCoopers and later joined the energy firm CalEnergy.

He joined Berkshire in 2000 through its acquisition of MidAmerican Energy, which was later renamed Berkshire Energy.

Abel oversees Berkshire’s non-insurance divisions, including BNSF Railway, Berkshire Hathaway Energy, and numerous chemical, industrial, and retail businesses.

When asked about how he would manage Berkshire’s subsidiaries compared to Buffett, Abel said more actively.

“He would make a huge mistake trying to be Warren Buffett, and he knows that,” said Fidelity Contrafund’s Will Danoff to the Wall Street Journal.

Abel takes charge of Berkshire at a time when the $1.1 trillion conglomerate is sitting on a cash pile of $348 billion.

Billionaire Bill Ackman suggested on Monday that Berkshire could introduce a dividend or become more aggressive with share buybacks.

Berkshire Class A shares have gained 12.4% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)