Advertisement|Remove ads.

Best Buy Stock Plummets As Trump Tariff Worries Outweigh Q4 Earnings Beat, But Retail Traders Are Buying The Dip

Best Buy Co. Inc. (BBY) shares plunged more than 13% on Tuesday, marking their worst session in nearly five years, as concerns over President Donald Trump's tariffs overshadowed a stronger-than-expected quarterly earnings report.

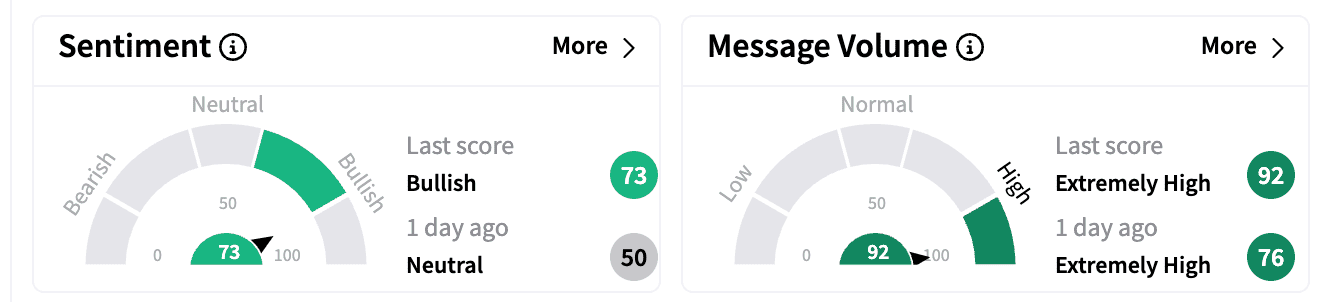

Despite the sharp decline, retail investors on Stocktwits appeared upbeat, with sentiment shifting from 'neutral' to 'bullish' by the end of the session.

The electronics retailer posted fourth-quarter adjusted diluted earnings per share of $2.58, beating analyst estimates of $2.40.

Revenue came in at $13.95 billion, exceeding Wall Street's consensus of $13.68 billion, driven by strong demand in computing and an improved sales performance across other categories.

However, the company's management warned that new tariffs — Trump's 25% levy on imports from Mexico and Canada and the doubling of tariffs on Chinese goods to 20% that went into effect on Tuesday — could lead to price increases and dampen consumer demand.

"The giant wildcard obviously is how the consumers are going to react to the price increases in light of a lot of price increases potentially throughout the year and a general consumer confidence that is showing little signs of weakness at the moment," CFO Matt Bilunas reportedly said.

For fiscal 2026, Best Buy expects adjusted diluted EPS between $6.20 and $6.60, compared to consensus estimates of $6.60. Revenue guidance came in between $41.4 billion and $42.2 billion, compared to analyst expectations of $41.81 billion.

Following the earnings release, retail activity on Stocktwits surged, with message volume inching up in the 'extremely high' zone.

One bullish trader responded to the sell-off by saying, "Thanks for the cheapies."

However, due to tariff-related concerns, a bearish trader projected a "window" of $60 to $50 for the stock.

Bilunas added that Best Buy expects consumer behavior in FY26 to remain largely in line with last year, with customers continuing to be value-conscious amid high inflation.

However, he noted that spending on high-ticket items remains strong when there is technological innovation or necessity.

The company projects comparable sales growth from flat to 2% for the year, with stronger growth in the second half due to the timing of product launches and initiatives.

For Q1 FY26, Best Buy expects a slight decline in comparable sales and an adjusted operating income rate of approximately 3.4%.

Truist analyst Scot Ciccarelli lowered the firm's price target on Best Buy to $81 from $95, maintaining a 'Hold' rating, according to The Fly, saying the "sizable earnings risk" from the tariffs could impact comparable sales by up to three percentage points.

The analyst also noted that while Q4 EPS and calendar 2025 guidance were largely in line, the initial 10% tariff on China could shave about one point off comparable sales.

Best Buy also announced a 1% increase in its quarterly dividend to $0.95 per share.

Shares of Best Buy are down 12.4% year-to-date. They were up more than 1.3% in Tuesday's after-hours trading.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)