Advertisement|Remove ads.

Microsoft’s AI-Powered Shopping Agents Aim To Streamline Retail Operations

- The offerings are designed to unify fragmented retail processes into a joined system that anticipates needs and acts autonomously.

- Among the new features is Copilot Checkout, which enables shoppers to complete purchases directly within conversations.

- Microsoft also introduced Brand Agents for Shopify merchants and a customizable shopping agent template in Copilot Studio.

Microsoft Corp. (MSFT) on Thursday launched a suite of agentic AI solutions designed to change and aid how retailers operate, engage customers, and drive sales.

The new tools seek to automate workflows across merchandising, marketing, fulfillment, and store operations, giving retailers a connected chain of intelligence to improve efficiency, speed, and customer relevance.

AI-Driven Retail

The offerings are designed to unify fragmented retail processes into a joined system that anticipates needs and acts autonomously. By equipping teams with context-aware tools, the solutions aim to help in the industry’s shift toward intelligence-driven operations.

Among the new features is Copilot Checkout, which enables shoppers to complete purchases directly within conversations without leaving Copilot to go to shopping sites. Partners supporting the system include PayPal, Shopify, and Stripe.

“Copilot Checkout can move a customer from intent to transaction in seconds, all without leaving the conversation.”

-Mani Fazeli, VP of Product, Shopify

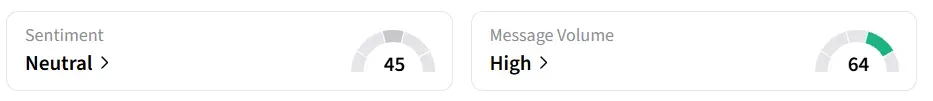

Microsoft stock traded over 1% lower on Thursday premarket. On Stocktwits, retail sentiment around the stock changed to ‘neutral’ from ‘bearish’ territory the previous day amid ‘high’ message volume levels.

Brand Agents

Microsoft also introduced Brand Agents for Shopify merchants and a customizable shopping agent template in Copilot Studio. The agents provide advanced capabilities like outfit building, real-time recommendations, and cross-channel interactions.

The tech giant’s catalog enrichment agent in public preview can extract product attributes, enhance data with social insights, and automate onboarding and categorization tasks.

Like its peers Microsft has been heavily investing in building its AI capabilities and partnerships. In 2025, the company disclosed a record $35 billion capital expenditure to build out its AI infrastructure. The tech giant’s $10 billion investment in Portugal and a $17.5 billion commitment in India reflect its diversified bet on AI and its capabilities to change how businesses function worldwide.

On Thursday, Wells Fargo revised its price target for the stock, lowering it to $665 from $700 while maintaining an ‘Overweight’ rating, according to TheFly. The firm highlighted that artificial intelligence remains a central driver of the technology sector in 2026, suggesting sustained investor interest despite near-term valuation adjustments.

MSFT stock has gained over 12% in the last 12 months.

Also See: Why Did Kratos Defense Stock Surge 17% Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iova_stock_jpg_ac0924fcdd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228840051_jpg_b05caad6aa.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)