Advertisement|Remove ads.

B&G Foods Stock Jumps After Offloading Don Pepino, Sclafani Brands — But Retail’s Not Impressed

B&G Foods (BGS) shares rose 5.2% on Tuesday, although they lost some of that gain in extended trading, after the company sold its Don Pepino and Sclafani brands, along with a New Jersey plant, to Violet Foods.

Financial details weren't disclosed.

The deal "is consistent with our efforts to reshape our portfolio, focus on our core brands, and reduce long-term debt," CEO Casey Keller said.

Don Pepino produces sauces used in pizza, while Sclafani sells tomato products, including puree, whole peeled tomatoes, and other tomato-based goods.

Violet Foods is a newly formed portfolio company of Amphora Equity Partners, a private equity firm specializing in the packaged food and beverage sector.

The divestiture is part of an ongoing strategy to offload smaller brands under B&G Foods, which is popularly known for Ortega (taco shells and sauces), Cream of Wheat (cereals), and Crisco (vegetable oils).

B&G sold its Green Giant canned goods line to Seneca Foods in 2023, and a year earlier, it offloaded the Back to Nature snacks brand to Barilla. The company is now exploring a sale of its Green Giant frozen division.

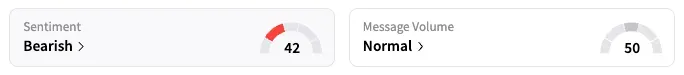

On Stocktwits, the retail sentiment dropped to 'bearish' from 'neutral.'

The user noted that the company's restructuring is underway, and it could be a good time to buy the stock.

BofA Securities acted as financial advisor to B&G Foods.

BGS shares are down 39% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)