Advertisement|Remove ads.

BHEL Faces Resistance Again: SEBI RA Sees Sell Signal If Stock Breaks ₹264.75

Bharat Heavy Electricals (BHEL) has been on a strong uptrend, gaining nearly 23% in the last three months.

However, the stock could be approaching a short-term correction, noted SEBI-registered analyst Kush Ghodasara.

In Monday’s trade, BHEL faced resistance at the same level seen during the May expiry, indicating a possible near-term ceiling, the analyst said. The stock opened at ₹272, fell to a low of ₹263.45, and then closed at ₹ 266.30.

At the time of writing, BHEL’s shares were trading at ₹264.

While momentum indicators were previously trending upward, they have now paused, suggesting caution, added Ghodasara. A breakdown below ₹264.75 could signal the start of a short-term correction.

The analyst recommended selling positions below ₹264.75, with the potential to target ₹258.80 and ₹252.20 on the downside. A stop-loss should be placed at ₹268.70, which is around yesterday’s high, he added.

This setup presents a favorable risk-reward for short-term traders looking to capitalize on a potential reversal from key resistance levels.

The electrical products manufacturer posted a whopping 90% increase in full-year net profit on a consolidated basis. Its revenue from operations rose over 18% during the same period. Since then, the stock has gained more than 5%.

The PSU company won a significant order from Adani Power after market hours on Friday. The news sent the shares up as much as 3% on Monday.

BHEL received a letter of award for the supply of steam turbine generators and other auxiliary equipment, as well as supervising the construction and commissioning of six 800 MW thermal units. The order is for a consideration of Rs 6,500 crore.

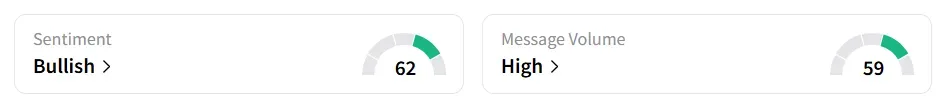

Retail sentiment on Stocktwits remained ‘bullish’ amid ‘high’ message volumes.

Year-to-date (YTD), BHEL’s shares have gained 14.7%

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)