Advertisement|Remove ads.

‘Big Short’ Investor Michael Burry Mocks Media Over His Palantir Short Bet, Says Their Math Was Off By Roughly 100x

- Palantir stock currently trades at a 73% discount to the per-share value of Burry's bearish bet.

- Citron said in a mid-August short report that Palantir is worth only $40 apiece.

- Burry has called out a bubble in the AI space — an industry that drove much of the upside seen in the bull run since late 2022.

Scion Asset Management founder Michael Burry, who famously bet against the U.S. housing market in 2008, took a potshot at financial media for their coverage of his firm's short bet against Palantir in a new post on X.

The hedge-fund manager emerged from a nearly two-year social-media hiatus in late October and has since been quick to engage, mainly issuing warnings about the artificial intelligence (AI) bubble.

Burry Calls Out Media

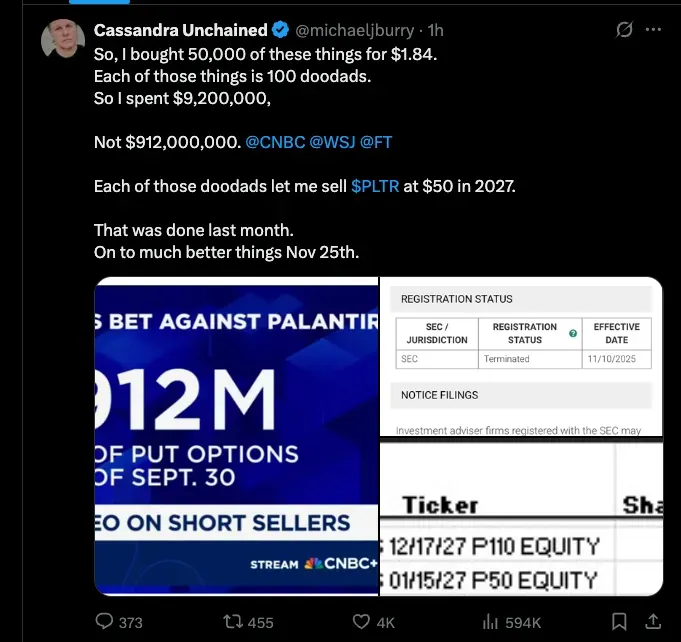

Sharing a screenshot of a CNBC headline that said Burry bought Palantir put options worth $912 million as of Sept. 30, Burry said he purchased 50,000 of the put options for $1.84 apiece. A put option provides a holder the right, but not the obligation, to sell a financial asset at a predetermined price before the expiration date.

A standard put option represents 100 shares, and the option price is quoted per share. So, to derive the cost of a single contract, the quoted premium is multiplied by 100.

"So, I bought 50,000 of these things for $1.84. Each of those things is 100 doodads. So I spent $9,200,000, Not $912,000,000. @CNBC @WSJ @FT," he said. "Each of those doodads let me sell $PLTR at $50 in 2027."

The $912 million figure comes from his Q3 2025 13F filing, a mandatory SEC disclosure of hedge fund holdings as of Sept. 30, 2025. In these filings, options positions are reported by their notional value, which represents the current market value of the underlying shares. In this case, that is 5 million shares at roughly $182 per share (Palantir’s price around that time), which results in about $912 million, a figure that reflects exposure, not the actual cash outlay.

Palantir stock ended Wednesday's session down 3.56% at $184.17. The stock is therefore trading at a roughly 73% discount to Burry's $50 price target. Incidentally, Citron said in a mid-August short report that Palantir is worth only $40 apiece.

Burry Wants To Move On

In his bio on X, Burry, who Christian Bale played in the 2015 movie "The Big Short", has teased the potential launch of a social media channel on Nov. 25. In his recent posts calling out hyperscalers such as Oracle and Meta for their disproportionate capital expenditures (capex) and for artificially inflating earnings by extending the useful life of assets, he said he would disclose more information by that date.

Some Stocktwits users also shared screenshots alleging that Burry "is shutting down his Scion Asset Management and will be returning capital to investors by year end." This could not be independently verified at the time of publishing.

However, Burry’s X bio currently teases a potential new venture on Nov. 25. One of his recent post images shows Scion’s SEC registration terminated effective Nov. 10, 2025 — hinting that he may be “unchaining” from traditional hedge fund regulations. Replies to the post on social media speculate it could be a blog, newsletter, or platform offering direct access to his trades or insights.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Disney On Retail's Radar Ahead Of Q4 Print: Did Jimmy Kimmel Saga Dent Streaming Performance?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)