Advertisement|Remove ads.

Bilibili Stock Surges On Strong Q4 Beat, Positive Outlook: Retail Stays Firmly Bullish On The Chinese Name

Bilibili, Inc.’s (BILI) Nasdaq-listed American Depository Share (ADS) rallied on Thursday after the online entertainment services provider reported its first-ever quarterly GAAP profit.

The Shanghai, China-based company reported fiscal year 2024 fourth-quarter (Q4) adjusted earnings per share (EPS) of 1.07 yuan per ADS or $0.15, reversing from the 1.07 yuan loss per share reported for the year-ago quarter.

The bottom-line result exceeded the 1.01 yuan-per-share consensus estimate, according to Yahoo Finance,

Quarterly revenue climbed 22% year over year (YoY) to 7.73 billion yuan or $1.06 billion, slightly ahead of the 7.64 billion yuan analysts’ estimate compiled by Finchat. Advertising revenue climbed 24% to $327.2 million, and mobile gaming revenue jumped 79% to $246.3 million.

CFO Sam Fan said the strong growth of high-margin advertising and mobile gaming revenue led to a 68% jump in gross profit.

Among user metrics, Bilibili’s average daily active users (DAUs) increased to 103 million from 100.1 million in the year-ago period. Fourth-quarter monthly active users (MAUs) were 340 million.

Bilibili Chairman and CEO Rui Chen said, “We closed 2024 on a strong note, achieving our first quarter of GAAP profitability”

Chen also emphasized the company’s artificial intelligence opportunity. He expressed confidence that the company can leverage its “high-quality and exclusive data assets” to exploit the new, affordable, open-source AI models.

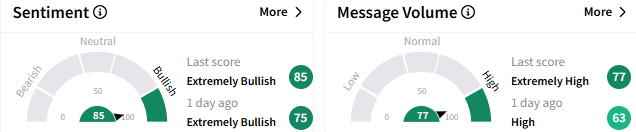

On Stocktwits, retail sentiment toward Bilibili stock remained ‘extremely bullish’ (85/100), while the message volume perked to an ‘extremely high’ level amid the earnings release.

A bullish watcher premised his optimism on the huge “rebalancing” they see in Chinese tech names as growth accelerates in China.

Another user said Bilibili is a company to bet on, given it is profitable and its key performance metrics are improving across the board.

Bilibili stock climbed 7.43% to $21.84 by the mid-session. The stock has gained about 23% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)