Advertisement|Remove ads.

Is Roku Stock A ‘Buy-And-Hold’ Investment After Recent Rally: Stocktwits Poll Shows Most Retailers Think So

Roku, Inc. (ROKU) shares breached the $100 psychological barrier last week for the first time since June 2022, thanks to the streaming device maker’s better-than-expected fourth-quarter results. The forward guidance was roughly in line with expectations.

The stock has since retreated below the level.

Despite the dip from the post-earnings high, retail investors are upbeat about the San Jose, California-based company.

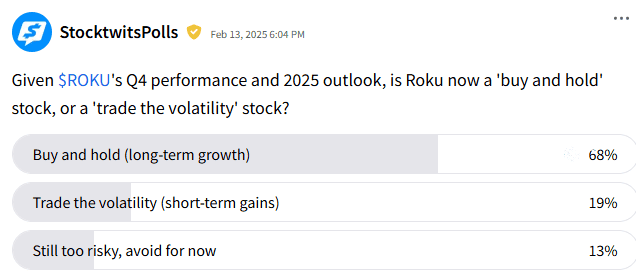

An ongoing Stocktwits poll found that most respondents see the Roku stock as a “buy-and-hold” bet. Only 19% of the respondents said they wanted to capitalize on the volatility. The remaining 13% sat on the sidelines.

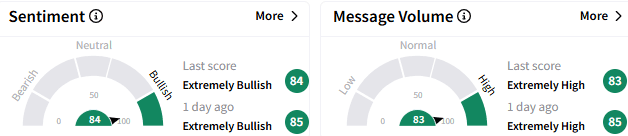

On Stocktwits, retail sentiment toward the stock remained ‘extremely bullish’ (84/100), with the buoyant mood accompanied by ‘extremely high’ message volume.

A bullish watcher who commented after Wednesday’s weakness said that in the eventuality of an extended weakness, the $85 support will hold good.

Another user reasoned that the recent weakness is not a sell-off and is potentially driven by traders staying on the sidelines. They expect a new 52-week high for the stock in the near term.

Separately, two brokerages issued upbeat commentary about Roku, TheFly reported. Jefferies upgraded the stock to ‘Hold’ from ‘Underperform’ and upped the price target to $100 from $55, citing the fourth-quarter outperformance.

Analysts at the firm said the bear case has weakened as the company outgrew many advertising peers in the December quarter.

Citi analysts increased the price target for Roku stock to $103 from $70 and maintained a ‘Neutral’ rating. The brokerage said that the company can execute its initiatives, but much of this is already priced into the stock at its current levels.

Roku stock slipped 0.64% to $91.82 in early trading. The stock is up 24% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com

Read Next: Unity Software Skyrockets After Q4 Beat: Retail Lauds Stock As ‘Great Value Play’

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)