Advertisement|Remove ads.

Biogen Stock To Pop Again? China Fast-Tracks At-Home Alzheimer’s Drug Leqembi

- China granted Priority Review for an at-home Alzheimer’s treatment developed by Biogen and Eisai.

- If approved, the subcutaneous version would allow once-weekly at-home dosing instead of biweekly hospital IV infusions.

- Analysts also raised price targets following Biogen’s Q4 earnings beat.

Shares of Biogen (BIIB) drew heightened retail chatter late Sunday after the company and partner Eisai said China’s drug regulator granted Priority Review to a subcutaneous formulation of Leqembi for the treatment of early Alzheimer’s disease.

BIIB stock jumped 9% on Friday to close at $201.18, marking its highest level in more than 16 months and its best session in over four months.

Leqembi At-Home Dosing

If approved, the subcutaneous formulation would enable once-weekly at-home dosing, rather than the intravenous dosing administered every two weeks at the hospital under the current regimen. The companies noted that each autoinjector delivers a 250 mg dose in about 15 seconds, requiring two injections per weekly dose.

Leqembi was launched in China in 2024 and was added to the country’s Commercial Insurance Innovative Drug List effective January 2026, under policies supporting access to innovative medicines. Eisai leads global development and regulatory submissions for Leqembi, and it and Biogen co-commercialize the product.

Analysts Raise Targets After Q4 Results

Biogen also saw a wave of target hikes following its fourth-quarter (Q4) earnings report.

Wells Fargo raised its price target to $200 from $190, implying a 0.6% downside from its last close and kept an 'Equal Weight' rating, saying it expects the company’s 2026 launch execution to remain steady and that near-term late-stage catalysts could improve the outlook toward the end of the decade.

Bank of America lifted its price target to $207 from $189, implying a 3% upside from current levels, and maintained a 'Neutral' rating, attributing the post-earnings share rally to what it called “clear positives” from the earnings call, including “not as bad as feared erosion” of the multiple sclerosis franchise.

Morgan Stanley raised its price target to $190 from $156, implying a 6% downside from current levels, and kept an 'Equal Weight' rating, saying the company’s “building” pipeline is now the focus following the Q4 report.

Citi increased its price target to $215 from $185, implying a 7% upside from last close, and reiterated a 'Neutral' rating, saying it views the Q4 report as solid and remains optimistic about Biogen’s ability to launch new products and develop its pipeline.

BMO Capital raised its price target to $196 from $165, implying a 3% downside from its last close, and kept a 'Market Perform' rating. The firm said revenue erosion from the multiple sclerosis business is expected to continue in 2026, but added it is growing more confident in the long-term opportunity for high-dose Spinraza and upcoming Litifilimab readouts in systemic lupus erythematosus.

BIIB Q4 Earnings

Biogen reported Q4 adjusted earnings per share (EPS) of $1.99, above consensus expectations of $1.63, on revenue of $2.3 billion, compared with a $2.2 billion consensus.

For full-year 2026, the company guided to adjusted EPS of $15.25–$16.25, above the consensus estimate of $14.95, and forecast revenue to decline mid-single digits versus 2025. Biogen also said its adjusted effective tax rate for 2026 is expected to be 17%–18%, with gross margin and combined non-GAAP research and development (R&D) and administrative expenses roughly consistent year over year.

How Did Stocktwits Users React?

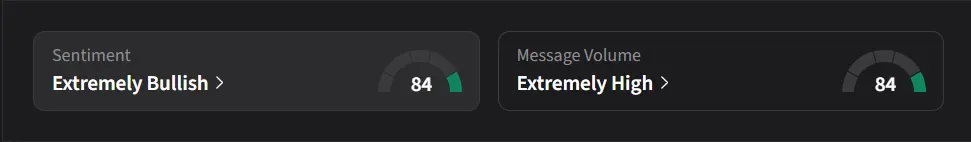

On Stocktwits, retail sentiment for BIIB was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said the stock stands out as a “high-quality large-cap biotech with real optionality,” citing a strong balance sheet, durable cash flows from its core neurology franchise, and multiple shots on goal across Alzheimer’s, depression, and rare neuro diseases.

Another user said, “feel like we should be over $200 already 210 or so. Hopefully this keeps momentum and goes to $220”

BIIB stock has risen 41% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)