Advertisement|Remove ads.

Biomerica Stock Slumps After Reverse Stock Split Announcement: Retail’s Disappointed

Shares of Biomerica, Inc. (BMRA) traded nearly 26% lower on Wednesday afternoon after the company said it would implement a 1-for-8 reverse stock split of the issued and outstanding shares of its common stock to increase its bid price.

The stock split will be effective at 12:01 a.m. ET on April 21, and Biomerica’s common stock will begin trading on a split-adjusted basis when the market opens on Monday, the company said.

Every eight shares of Biomerica’s pre-split common stock issued and outstanding will be automatically reclassified as and converted into one new share of Biomerica’s common stock, subsequently reducing the number of outstanding shares from about 20.4 million to about 2.5 million.

The move is aimed at enabling the biomedical technology company to regain compliance with the minimum $1.00 per share bid price requirement for continued listing on the Nasdaq Capital Market.

To regain compliance, Biomerica’s common stock must close at or above a $1.00 per share bid price for at least ten consecutive business days prior to May 5.

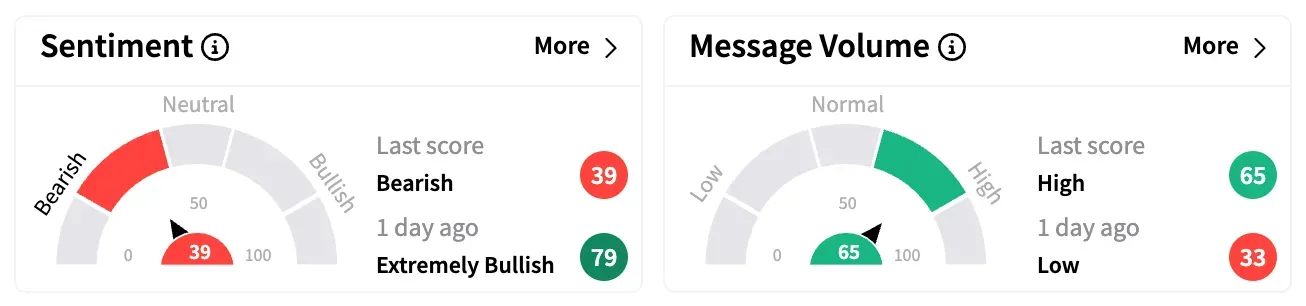

On Stocktwits, retail sentiment around Biomerica fell from ‘extremely bullish’ to ‘bearish’ territory over the past 24 hours while message volume rose from ‘low’ to ‘high’.

A Stocktwits user, however, opined that today marks a good opportunity to buy the stock as the reverse split is “not that big of a deal” and the company has a strong cash runway.

Biomerica’s cash and cash equivalents totaled $3.06 million as of February-end, marking an increase from $2.37 million at the end of the second quarter (Q2) of fiscal 2025.

BMRA stock is up by about 42% year-to-date but has fallen 43% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)