Advertisement|Remove ads.

Ford Made $900M From China Business In 2024, Says Report: Retail Sentiment Brightens But Still Bearish

American automaker Ford Motor Co. (F) made $900 million in earnings before interest and taxes (EBIT) last year from its China business including exports, Reuters reported.

Ford’s vice chair and former chief financial officer, John Lawler, gave insights into the company’s China business at an analyst conference.

The revelation gains importance in light of the tariff war between China and the U.S. Trump has imposed significant levies on imports from China, the cost of which is expected to be passed down to customers.

Ford assembles its Lincoln Nautilus in China and exports it into the U.S. market. The company sold 36,544 units of the vehicle in the U.S. last year.

The automaker reported a total adjusted EBIT of $10.2 billion in 2024, implying that its China business accounted for 8.8% of its overall EBIT.

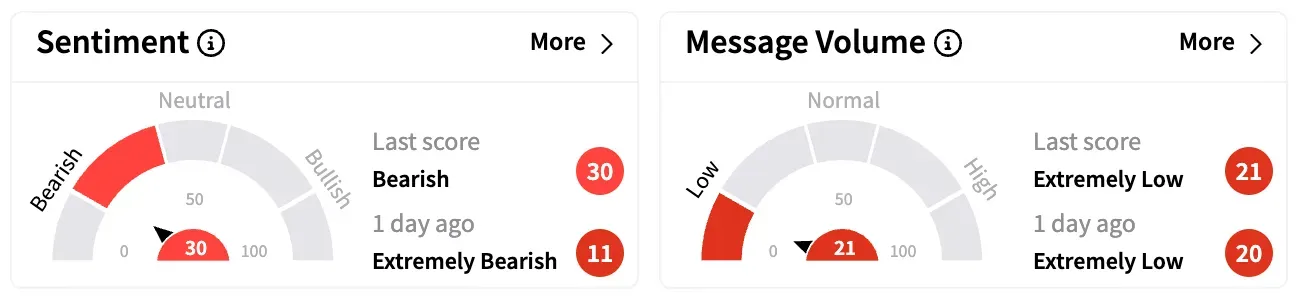

On Stocktwits, retail sentiment around Ford rose from ‘extremely bearish’ to ‘bearish’ over the past 24 hours while message volume remained at ‘extremely low’ levels.

Barclays, on Tuesday, downgraded the U.S. autos and mobility sector to ‘Negative’ from ‘Neutral’ in light of the impact of Trump’s tariffs while lowering its price target on Ford to $8 from $10.

The firm kept an ‘Equal Weight’ rating on the shares and said that it maintains a slight preference for Ford over rival General Motors, given that Ford manufactures more vehicles in the U.S.

Last week, Goldman Sachs cut its estimates for automobile sales in the U.S. in 2025 by nearly one million to 15.40 million units, adding that the tariffs will raise the cost of importing and manufacturing vehicles in the U.S.

Goldman Sachs expects the net price of new vehicles in the U.S. to rise by about $2,000 to $4,000 over the next 6-12 months as car manufacturers pass on tariff-related costs.

Ford stock is down by about 1% this year and over 21% over the past 12 months.

Also See: iCAD Stock Rockets On Merger Announcement With RadNet: Retail’s Elated

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)