Advertisement|Remove ads.

Biotech Bull ETF Surges To 20-Month High: Analysts Say Medicare’s Drug-Pricing Blow Is Softer Than Feared

- Analysts said Medicare’s drug-price cuts were smaller or already reflected in forecasts.

- Pricing updates for major therapies from Novo Nordisk, Teva, AbbVie, and others eased sector worries.

- Retail traders on Stocktwits turned extremely bullish on LABU as message volume surged.

The biotech sector rallied sharply on Wednesday after Wall Street analysts said the latest round of U.S. Medicare drug-price cuts would have a smaller impact on pharmaceutical companies than initially feared, lifting the Direxion Daily S&P Biotech Bull 3X Shares ETF (LABU) to its highest level in nearly 20 months.

The LABU ETF extended its rally on Wednesday, rising 3.7% to close at $165.5 and edging up 0.2% after hours, marking its fourth straight session of gains.

Bernstein Says Semaglutide Pricing Is ‘Final Cloud To Clear’

Shares of major drugmakers jumped after the U.S. government published negotiated Medicare prices for 15 drugs late Tuesday, with cuts of up to 85% scheduled to begin in 2027.

Novo Nordisk’s U.S.-listed shares rose nearly 4%, and Teva Pharmaceuticals gained over 5%, after their flagship therapies appeared on the pricing list. Novo’s semaglutide drugs, Ozempic and Wegovy, along with Teva’s Austedo, were included among the treatments subject to reductions.

Bernstein analyst Christian Moore said the negotiated price for Novo’s semaglutide was “the final cloud to clear on the drawn-out, but positively resolved GLP-1 pricing debate,” Reuters reported.

Goldman Sachs Says Austedo Cut Milder Than Expected

Goldman Sachs analyst Matt Dellatorre noted that Austedo’s 38% price cut came in lower than the roughly 45% reduction modeled. He said the updated government price, which is a little over $700 lower per monthly supply versus one estimate of its net price, was below expectations and therefore less damaging for Teva.

Guggenheim Flags Deeper Than Expected Cuts For AbbVie

Guggenheim analyst Vamil Divan said AbbVie’s cuts on Linzess and Vraylar, which come up to 75% and 44%, respectively, were deeper than anticipated.

Two analysts said they are now watching how Medicare plans will manage access to the first batch of 10 drugs whose new negotiated prices take effect in January 2026, and what the Feb. 1 announcement of the next 15 drugs for 2028 will reveal.

Bernstein, William Blair, And Others Say Impact Already Priced In

Bernstein analysts said five of the 15 targeted medicines will be generic by 2027, limiting exposure to deeper cuts. They added that lower prices could keep patients on branded therapies longer, potentially supporting volumes.

William Blair analysts said the $274 monthly Medicare price for Novo’s semaglutide broadly tracks recent government agreements but added that insurance-coverage expansion remains uncertain. Analysts also said reductions had already been reflected in forecasts for Novo Nordisk, AstraZeneca and GSK.

Earlier this month, Novo said it expected a low single-digit global sales impact if pricing were implemented this year, which analysts indicated translates to roughly DKK 6 billion.

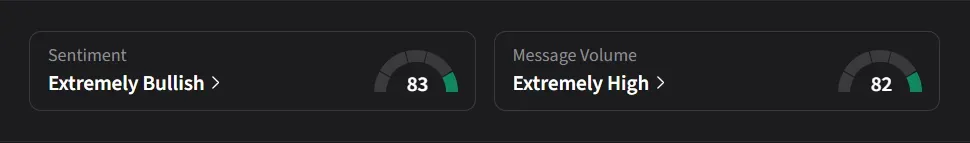

Liquidity Wave Drives LABU Frenzy On Stocktwits

On Stocktwits, retail sentiment for LABU was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “This concentrated burst of purchasing power is pushing up prices.”

Another user said the move looks close to a blow-off top, possibly around $165–$175, and warned that any pullback could echo the sharp drop seen after the Covid peak.

The LABU ETF has risen 22% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228875477_jpg_4c76a2e8b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213365850_jpg_470b9c6c06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lithium_47e0215e10.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_evolent_jpg_3c3f2aa8e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250655281_jpg_c8c0e9352f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)