Advertisement|Remove ads.

Birkenstock Stock Tumbles 12% Pre-Market After FY26 Projections Fail To Impress Investors

- The company projects FY26 adjusted EPS in the range of €1.90 to €2.05.

- It estimates FY26 revenue in the range of €2.30 billion to €2.35 billion.

- Birkenstock cited headwinds from currency translation and incremental tariffs on its projections.

Birkenstock Holding (BIRK) shares tumbled nearly 12% in Thursday’s premarket after the company’s FY26 revenue and adjusted profit projections fell below analyst estimates, as tariff uncertainty weighs on demand.

The company that largely makes its products in Germany has increased prices to mitigate the impact of Donald Trump’s 15% tariffs on EU imports, but continues to see muted sales growth as it joins a slew of consumer companies hurt by sweeping U.S. tariffs and elevated inflation.

The German footwear company projected adjusted profit for FY26 in the range of €1.90 to €2.05 per share ($2.23 to $2.40), below analyst estimates of €2.09 per share, according to Fiscal.ai. It also projected a 100-basis-point hit to its annual gross margin due to the tariffs' impact.

Revenue Projections

The company’s FY26 revenue estimate of €2.30 billion to €2.35 billion also fell below the €2.39 billion estimate. However, the company’s fourth quarter (Q4) revenue of €526 million edged above analyst estimates of €521 million, as tariff impact was somewhat cushioned by robust demand for its products.

The company said it expects to invest in capital expenditures of €110 million to €130 million in 2026, well above the €85 million it invested in 2025 to expand production capacity.

How Did Stocktwits Users React?

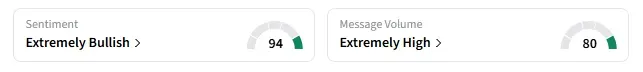

On Stocktwits, the retail sentiment around BIRK remained ‘extremely bullish’, and message volume remained ‘extremely high’. The stock was among the top 10 trending stocks on Stocktwits.

Shares in Birkenstock have fallen 19% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

(Exchange Rate: €1 = $1.17)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_stock_jpg_770e12377f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rocket_companies_logo_resized_jpg_1cfb06fa99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corcept_therapeutics_jpg_0778e9d4e5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cryptocurrency_generic_jpg_4184e1dbd8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iova_stock_jpg_ac0924fcdd.webp)