Advertisement|Remove ads.

Bitcoin Dips Below $111,000 On Mounting China-US Trade Tensions

Bitcoin and major cryptocurrencies edged lower on Thursday amid growing tensions between the U.S. and China over tariffs.

The apex cryptocurrency was down over 1.7% at $110,673.64 at the time of writing, as per CoinMarketCap data. Ethereum slipped over 3% to $3,999.10, XRP dipped 3.7% to $2.41, while BNB was down 0.5% to $1181.95. Among other tokens, Solana was down 5.5% and Dogecoin was down 3.3%.

According to SoSoValue data, spot Bitcoin ETFs logged outflows of $94 million on Wednesday, with Grayscale’s GBTC ETF also seeing outflows of over $82 million. It was the third time in the previous four sessions that Bitcoin ETFs recorded net outflows, indicating that investors are cautious about digital assets.

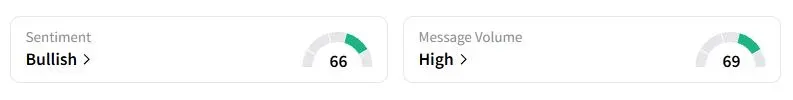

Retail sentiment on Stocktwits about Bitcoin was in the ‘bullish’ territory at the time of writing.

The recent weakness in cryptocurrencies has been driven by the escalation of trade tensions between the U.S. and China after Beijing imposed curbs on rare earth exports last week. The two sides then slapped fees on ships originating from each other, before Trump threatened a 100% tariff hike on all Chinese goods.

U.S. Treasury Secretary Bessent said on Wednesday that the U.S. could take further actions, including export controls, if Beijing took retaliatory measures and was also ready to impose tariffs on China over its purchases of Russian oil, if European allies agreed to do the same.

However, some analysts have said that the dip could be a temporary snag. “Despite the structural weakening in Bitcoin’s short-term fundamentals and price momentum, liquidity conditions and large investor accumulation remain supportive. A sustained break above the Traders’ Realized Price ($115K) would confirm renewed strength and could mark the resumption of the broader upward trend,” CryptoQuant analysts noted earlier this week.

Also See: Gold Prices Notch Another Record High On Simmering US-China Tensions, Rate Cut Prospects

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)