Advertisement|Remove ads.

MSTR Stock Falls 7% Pre-Market After Strategy Moves Over 47,000 BTC – But Michael Saylor Says ‘HODL’

- MSTR stock was on track to hit a one-year low in pre-market trade on Friday.

- Traders are concerned that the company may be selling Bitcoin for the first time in two years after moving more than 47,000 BTC.

- Executive Chairman Michael Saylor posted ‘HODL’ on X with an image of a burning ship, suggesting the moves were transfers to new wallets rather than sales.

Strategy (MSTR) shares were on track to hit a more than one-year low in pre-market trading on Friday after the company moved more than 47,000 Bitcoin (BTC) to new wallets. The move has traders worrying that Strategy may be selling Bitcoin again for the first time in two years.

In an early morning post on X, Executive Chairman Michael Saylor posted ‘HODL’ with an image of a burning ship behind him – suggesting that MSTR was not selling its holdings but moving them to new wallets, with no intention to sell. The last time Strategy sold Bitcoin was in December 2022, when it sold 704 BTC at around $17,800 per Bitcoin.

MSTR’s stock fell as much as 7% in pre-market trade and was among the top trending tickers on Stocktwits. It was trading at levels last seen in October 2024. Retail sentiment on the platform around the Bitcoin proxy dipped to ‘neutral’ from ‘bullish’ over the past day, but chatter remained at ‘high’ levels.

Strategy Moves Its Bitcoin

According to Arkham Intelligence data, Strategy’s Bitcoin holdings declined from more than 484,000 BTC to 437,431 BTC over the last 24 hours. The value of the remaining holdings also fell more than 6.7%, dropping to roughly $42 billion along with the dip in Bitcoin’s price. The apex cryptocurrency fell below $96,000 in early morning trade on Friday – the lowest it’s been since May.

It’s unclear whether the shift in holdings came from transfers or sales. This is the first reported decrease since July 2023, after months of steady accumulation.

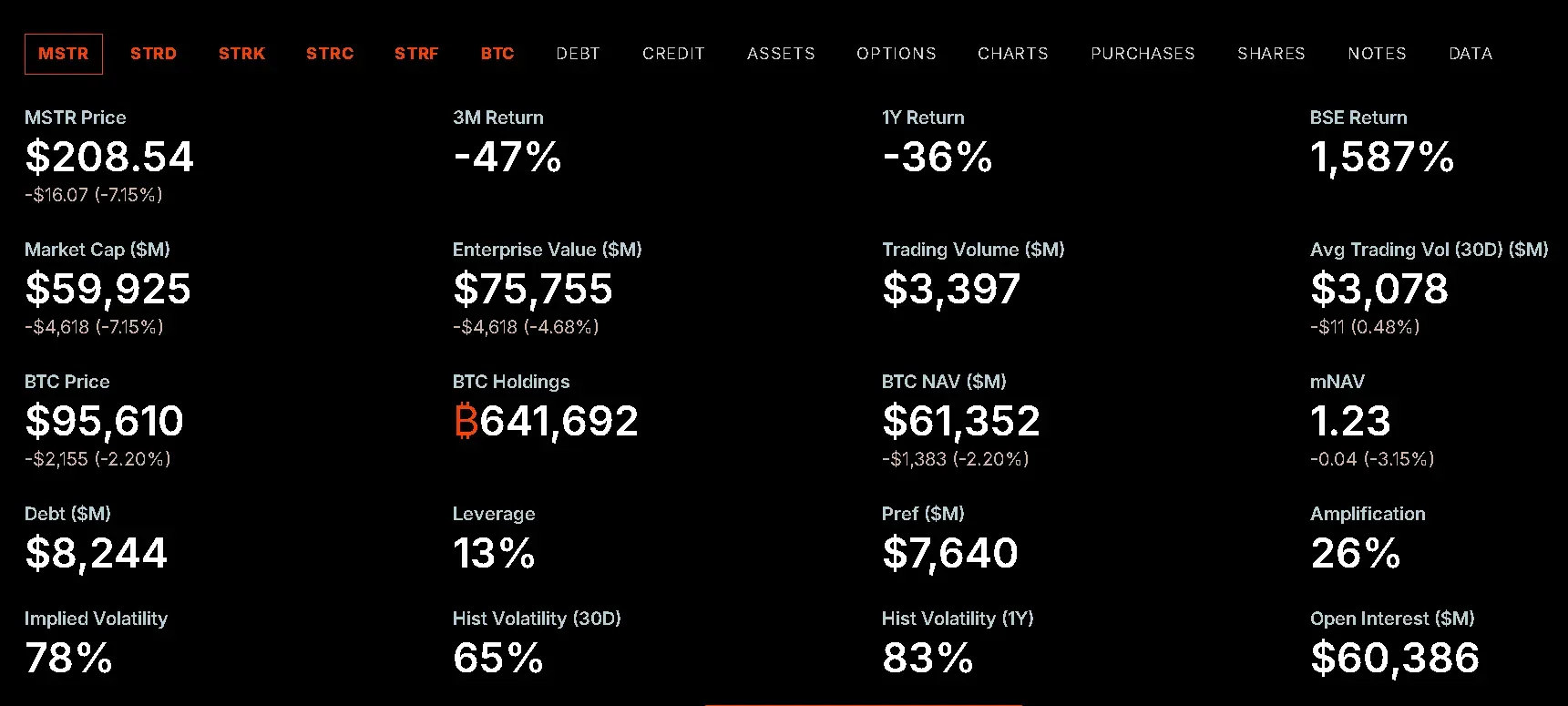

Strategy’s official dashboard does not reflect a sale, still showing over 640,000 BTC with an mNAV of 1.23.

It’s unclear whether this came from transfers or sales. This is the first reported decrease since July 2023, after months of steady accumulation.

However, online trader and analyst Derivatives Monke noted that Strategy’s shares have fallen below 1 NAV to 0.96, indicating that the value of its Bitcoin holdings is approaching the company’s total debt. “Traders are front-running the death spiral of MSTR and its eventual BTC force selling,” Monke wrote on X.

MSTR’s stock has fallen more than 30% this year and more than 43% over the last 23 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194650023_jpg_2af2244b5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathie_wood_OG_2_jpg_c5be4c4636.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055049_jpg_0a316df698.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)