Advertisement|Remove ads.

Bitcoin-First Fund Ego Death Raises $100M To Scale BTC-Focused Startups

Bitcoin (BTC) venture capital firm Ego Death Capital announced on Tuesday that it has closed a $100 million funding round focused on scaling BTC-focused companies that utilize the cryptocurrency’s foundational infrastructure.

"We're in bitcoin, investing in true companies ... that are solving real-world problems," Nico Lechuga, one of the founding partners, told Axios.

Bitcoin traded at $106,769, gaining 0.4% in the last 24 hours.

Ego Death focuses on founders developing businesses on the Bitcoin network, particularly those earning between $1 million and $3 million annually and aiming to secure Series A funding to scale their operations.

The fund’s backers are primarily Bitcoin-aligned family offices seeking to expand the cryptocurrency ecosystem. Ego Death’s first investments include Roxom, a Bitcoin-based exchange, savings-app Relai and Breez, a payments provider built on the Lightning Network.

The fund explicitly excludes hardware producers and Bitcoin mining enterprises. Unlike many crypto-focused investors, Ego Death opts out of token speculation, said the Axios report.

Lechuga highlighted that many Bitcoin software companies generate recurring revenue in BTC, potentially outperforming Bitcoin itself due to their sustainable monetization models.

He stated the firm believes Bitcoin is “the only decentralized and secure base” suitable for building enduring businesses.

The Trump administration’s strong backing of crypto has prompted numerous companies to adopt Bitcoin in their treasury strategies as well.

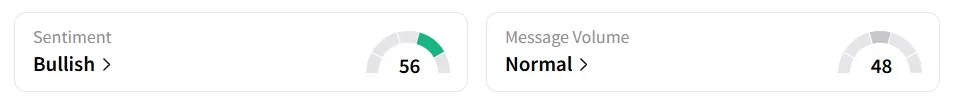

On Stocktwits, retail sentiment toward Bitcoin improved to ‘bullish’ from ‘neutral’ territory the previous day.

Also See: SharpLink Gaming Boosts Ethereum Reserve To 205K: Retail Optimism Abounds As Stock Surges

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)