Advertisement|Remove ads.

Bitcoin Miner MARA Sees 25% Drop In Output Due To Storms, But Retail Stays Bullish

MARA Holdings Inc. (MARA), a major player in digital energy and crypto infrastructure, released its unaudited Bitcoin production figures for June 2025 and shared its full-year hashrate forecast.

The firm mined 713 BTC in June, down 25% from May’s 950 BTC, with an average daily output of 23.8 BTC, compared to 30.7 BTC in the previous month.

Despite the news, MARA stock traded over 1% higher on Tuesday afternoon.

The decline was primarily driven by reduced operational uptime resulting from weather-induced power curtailments, as well as the short-term deployment of older mining equipment in Garden City during storm recovery efforts, said Chairman and CEO Fred Thiel.

MARA’s energized hashrate slipped slightly to 57.4 EH/s from 58.3 EH/s in May, while its proportion of network miner rewards decreased from 6.5% to 5.4%.

Transaction fees accounted for approximately 1.4% of its total Bitcoin income for the month.

The company ended June holding 49,940 BTC. MARA chose not to sell any of its Bitcoin holdings during the month, indicating a strategy focused on accumulation.

"With 1.7 gigawatts (“GW”) of captive capacity – including 1.1 GW currently operational – and a growth pipeline exceeding 3 GW of low-cost power opportunities, we are targeting 75 exahash by the end of 2025,” said Thiel.

“This target represents over 40% growth from 2024, supported by machine orders already in place.”

For the first quarter of 2025 (Q1), MARA’s revenue climbed 29.4% YoY to $213.8 million, missing the analyst consensus estimate of $217.5 million, as per Finchat data.

The company held $2.08 million in cash and equivalents as of the end of March.

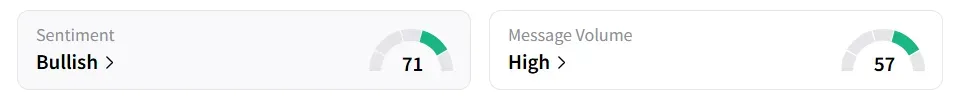

On Stocktwits, retail sentiment around MARA remained in ‘bullish’ territory, while the message volume changed to ‘high’ from ‘normal’ levels in 24 hours.

MARA stock has lost over 5% year-to-date and over 29% in the last 12 months.

Also See: Jumia Shares Jump As Axian Mulls Buyout of E-Commerce Giant: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264976085_jpg_5ac49235ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_newsmax_resized_jpg_3a813181b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192591876_jpg_b8c2306674.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)