Advertisement|Remove ads.

Bitcoin Miner TeraWulf’s Upsized Note Offering Weighs On Stock But Doesn’t Dent Retail Sentiment

TeraWulf, Inc. ($WULF) shares slipped early on Thursday after the company said it upsized its previously announced convertible note offering and announced the pricing of the offering.

Easton, Maryland-based TeraWulf said it has increased the size of its private offering of convertible senior notes from $350 million to $425 million.

The Bitcoin ($BTC.X) miner is offering convertible senior notes that will accrue interest at a 2.75% rate and is due to mature on Feb. 1, 2030, unless earlier repurchased, redeemed or converted in accordance with their terms.

The capped call transactions entered into in connection with the offering has an initial cap price of $12.80 per share, a 100% premium to the closing price on Wednesday, when the company first announced the offering.

TeraWulf said it expects to use the net proceeds of $414.9 million to pay the cost of the capped call transactions, repurchase shares and meet general corporate expenses.

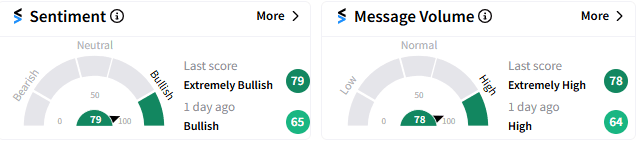

The stock decline has not dented confidence of retail investors as reflected by the ‘extremely bullish’ sentiment seen on Stocktwits (70/100) as of 9:45 am ET, accompanied by 'extremely high' message volume.

Some retailers see the stock going up over the course of trading on Thursday.

Others have begun calling for the stock hitting the $15 threshold as they see the debt offering as a prudent move.

In early trading on Thursday, TeraWulf fell 1.17% to $6.32.

Read Next: UPS Stock Soars Pre-Market, Keeps Retail Bullish As Q3 Beat Pleases Wall Street

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_ae45d5de0e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2234227546_jpg_b7fa546ca4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)