Advertisement|Remove ads.

UPS Stock Soars Pre-Market, Keeps Retail Bullish As Q3 Beat Pleases Wall Street

Shipping giant United Parcel Service, Inc. ($UPS) reported Thursday ahead of the market open a double earnings beat, lifting its shares in premarket trading.

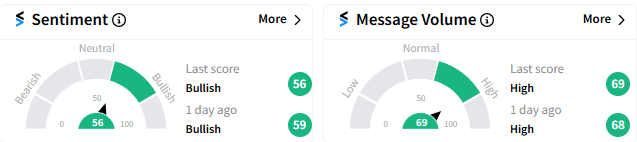

On Stocktwits, sentiment for UPS was ‘bullish’ (56/100), with message volume remaining ‘high.’ The stock was among the top 10 trending tickers.

Atlanta, Georgia-based UPS reported third-quarter non-GAAP earnings per share (EPS) of $1.76, up about 12% from a year ago and beating the consensus estimate of $1.63.

The earnings growth was partly aided by a 5.6% year-over-year (YoY) increase in revenue to $22.2 billion. This top-line just squeaked past the analysts’ average estimate of $22.1 billion.

UPS noted a 6.5% increase in average daily volume in the U.S., while a 2.5% increase in revenue per piece helped its international segment. Revenue contribution from these two segments was roughly 65% and 20%, respectively.

Supply-chain solutions, which made up 15% of the total revenue, saw 8% revenue growth, primarily due to growth in air and ocean forwarding and the continued onboarding of USPS air cargo.

“After a challenging 18-month period, our company returned to revenue and profit growth,” said CEO Carol Tomé in a statement.

Looking ahead, UPS anticipates revenue of $91.1 billion for 2024 and non-GAAP adjusted operating margin of about 9.6%. Previously, the company expected the metrics to be at $93 billion and 9.4%, respectively.

The company said the guidance has been adjusted to reflect the third-quarter results, Coyote disposal and the fourth-quarter guidance.

It expects to pay out $5.4 billion in dividend, subject to shareholder approval.

The retail crowd was generally about margin growth and dividend.

In premarket trading, as of 8:50 am ET, the stock climbed 8.73% to $142.88, marking the highest level since late-July.

Read Next: Lam Research Stock Surges 6% On Upbeat Q1 Results: Retail Goes Gaga

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es6_jpg_b768981c5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228901180_jpg_0c2cc7dc28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)