Advertisement|Remove ads.

Bitcoin Crash Hammers Mining Stocks Taking MARA Toward Year-Low Level: Retail’s Split On Whether To Sell Or Hold

Shares of Bitcoin mining companies slid in pre-market trade on Tuesday as Bitcoin’s (BTC) value dipped below $90,000, intensifying selling pressure across the sector.

Marathon Holdings Inc. (MARA) fell about 3.5% and is now on track to hit a one-year low if losses hold. At the same time, sentiment among retail traders remains divided on whether to cut losses or hold through the volatility.

Hut 8 Corp. (HUT) was the worst hit, dropping nearly 5% to a three-month low. Cipher Mining Inc. (CIFR), CleanSpark Inc. (CLSK), and Bit Digital Inc. (BTBT) each lost around 4%.

Bitcoin, which had been trading in a tight range in recent weeks, fell as low as $86,873 late Monday, significantly below its all-time high of nearly $109,000 last month, according to CoinGecko.

The cryptocurrency has struggled to reclaim the $90,000 level in the hours since, weighing on mining stocks.

Bitcoin’s decline mirrored losses in technology stocks and a stronger Japanese yen, signaling a shift toward safer assets, while geopolitical uncertainty under President Trump’s administration added to market jitters.

Crypto ETPs saw $924 million in outflows over two weeks, reversing 18 consecutive weeks of inflows, as investor confidence took a hit following the $1.46 billion Bybit hack.

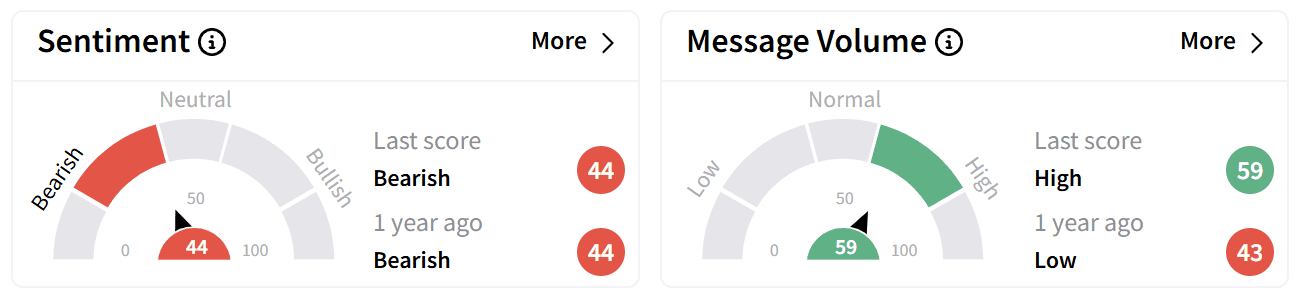

On Stocktwits, sentiment around MARA’s stock was ‘bearish, ’ but trading activity was notably higher than that of its peers.

Investors debated whether to "buy the dip" ahead of the company’s earnings on Wednesday or exit before further losses.

Marathon, the largest Bitcoin-holding miner, is on track for a one-year low if the downturn continues. The stock is down 43% in 2024, with 20% of those losses occurring this year alone.

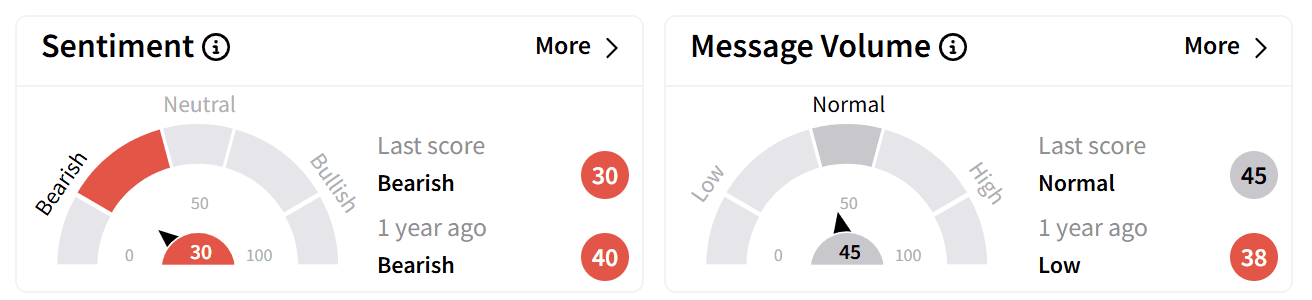

Meanwhile, retail sentiment on Stocktwits around Hut 8’s stock was also in the ‘bearish’ territory.

Some investors blamed the Trump administration’s tariff policies for the increased volatility in risk assets, while others were holding out for the company’s earnings report next week.

Hut 8’s shares are trading at 3-month lows with a nearly 21% drop this year, but the stock has still doubled in value over the past year.

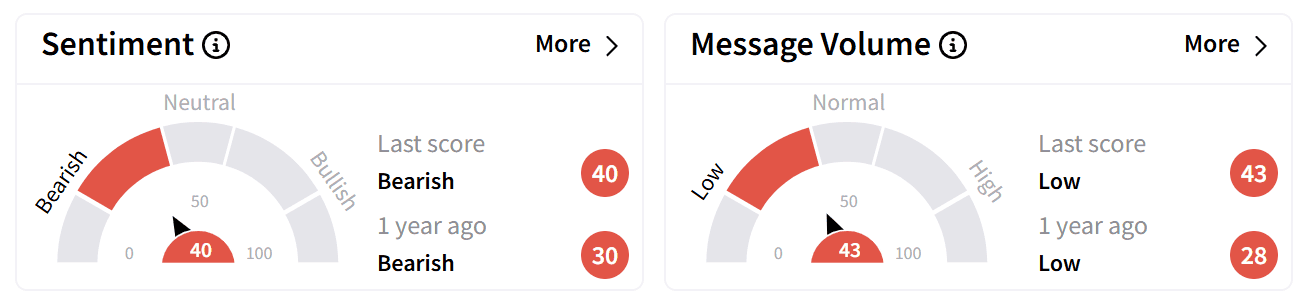

Retail sentiment on Stocktwits around CleanSpark was also in the ‘bearish’ territory. Still, the ticker saw an uptick in chatter, with many investors on the platform viewing the price drop as an opportunity to buy the stock at a discount.

Despite trading at a four-month low after an 11% slide over two days, the company’s shares are still way above their 52-week low. Over the past year, CleanSpark’s stock has lost about 3.37%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)