Advertisement|Remove ads.

Retail Traders Bet Big On Strategy’s Stock Ahead Of Michael Saylor’s Appearance At Trump’s White House Crypto Summit

Retail investors on Stocktwits are overwhelmingly bullish on Strategy (MSTR), formerly known as MicroStrategy, ahead of co-founder Michael Saylor’s appearance at the White House Digital Assets Summit on March 7.

The stock, known for being a Bitcoin (BTC) proxy, has gained 15% over the past week but remains down 11% for the month.

After surging more than 12% in the previous session, shares were down nearly 3% in pre-market trading on Thursday.

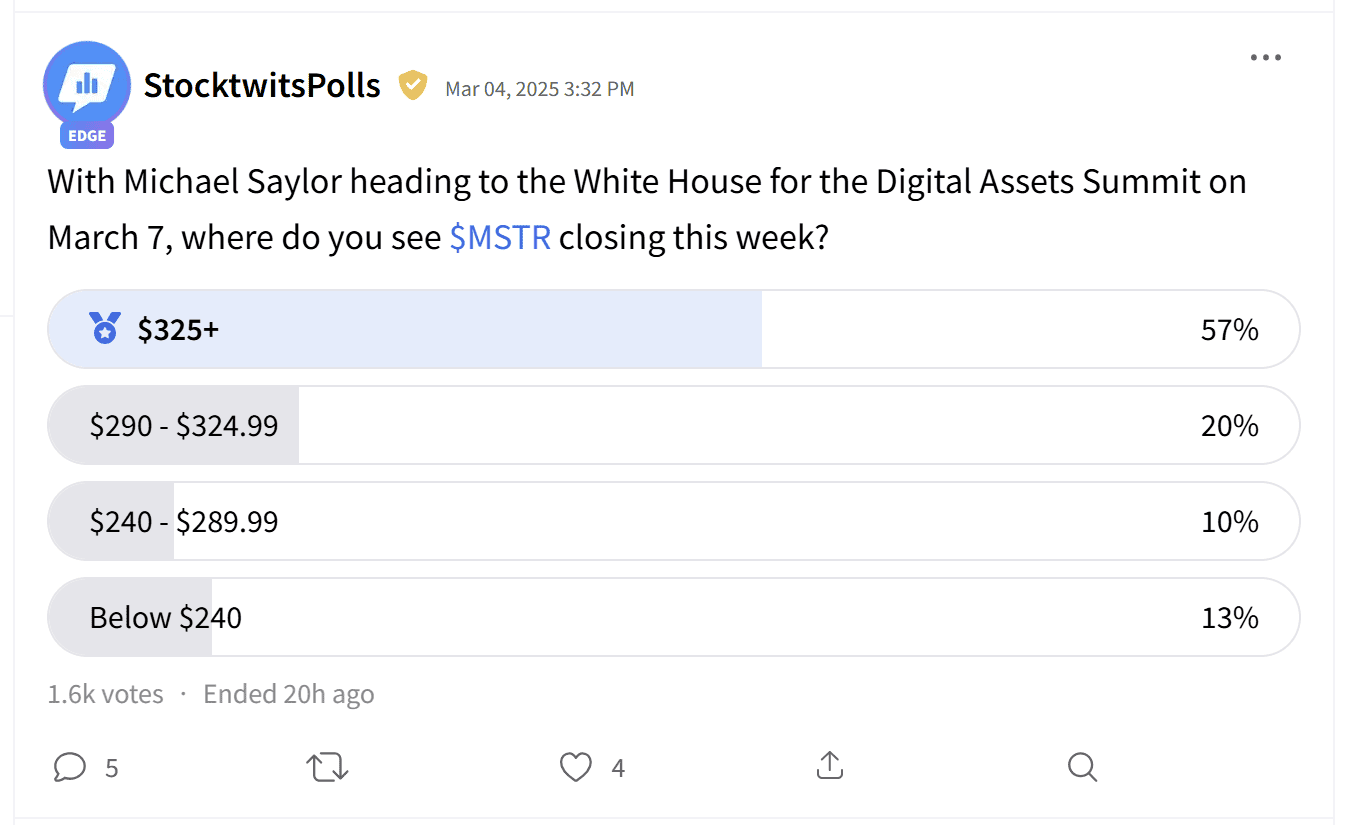

A Stocktwits poll showed that 57% of respondents expect Strategy’s stock to close above $325 this week. This implies an upside of 5% from Wednesday’s closing and highlights confidence in the company’s Bitcoin-heavy strategy.

Meanwhile, only 13% of retail traders foresee a drop below $240, indicating that bearish sentiment remains muted despite broader market volatility.

Saylor fueled speculation around Bitcoin’s future in U.S. policy with recent comments to FOX Business, where he suggested the federal government could purchase one million BTC for its strategic reserves.

He referenced a “six-month process” outlined in a recent executive order and emphasized that decision-making would involve multiple stakeholders, including a 12-member presidential working committee, industry representatives, and lawmakers.

“It’s above my pay grade to decide how it is determined,” Saylor noted, sidestepping specifics on execution.

He emphasized that if the U.S. government clarified Bitcoin’s status, it could instill greater confidence in citizens considering cryptocurrencies as legitimate savings vehicles.

However, some traders on Stocktwits question whether optimism around Saylor’s White House appearance could lead to a speculative run-up in Strategy’s stock, leaving some buyers as ‘bag holders’ – investors who hold onto declining assets in hopes of a rebound that never materializes.

Strategy has been a standout performer among crypto-related equities. The company currently holds over 499,096 BTC, acquired at an average cost of $66,423 per coin, representing a 37.7% unrealized gain, according to Bitcoin Treasuries.

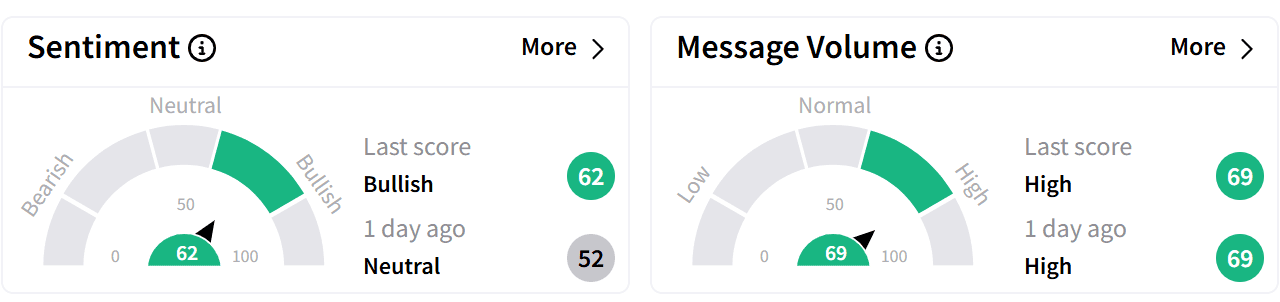

On Stocktwits, retail sentiment around Strategy’s stock improved to ‘bullish’ from ‘neutral’ a day ago, accompanied by ‘high’ levels of chatter.

As Saylor prepares to take the stage in Washington, all eyes will be on how policymakers react – and whether Strategy’s stock can sustain its rally.

The stock has more than doubled over the past year, outpacing Bitcoin’s gains of around 37% during the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Retail Buzz Around Trump’s Crypto Reserve Plans Overshadows Tax Breaks Ahead of White House Summit

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)