Advertisement|Remove ads.

Trump’s Crypto Reserve Token Plan Fuels Bitcoin, Dogecoin And Crypto-Linked Stocks Rally — Retail Thinks Centralization Is Coming

President Donald Trump’s announcement of tokens for the Strategic Crypto Reserve has sent major cryptocurrencies like Bitcoin (BTC), Dogecoin (DOGE), Ethereum (ETH), and Ripple (XRP) skyrocketing.

In a post on Truth Social, Trump announced that while Bitcoin and Ethereum will be at the heart of the reserve, the list also includes XRP, Solana (SOL), and Cardano (ADA).

Despite not being on the list, Dogecoin hitched a ride with its fellow tokens, surging over 11% at the time of writing.

“A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA,” Trump said.

Trump’s announcement also sent Bitcoin skyrocketing past the $90,000 mark again after it fell to $84,000 last week. At the time of writing, Bitcoin was trading at $93,010, up by nearly 8%.

Crypto-linked stocks like Strategy Inc. (MSTR), Marathon Holdings Inc. (MARA), Hut 8 Corp. (HUT), among others, also surged to close on a positive note on Friday.

While Strategy and Marathon Holdings stocks gained over 6%, mining stocks like Hut 8, Cipher Mining Inc., gained more than 2%. Terawulf Inc. stock closed Friday with 16% gains, while Riot Platforms Inc. ended up by over 7%.

Adding to the momentum is the first White House crypto summit that is set to be held this Friday.

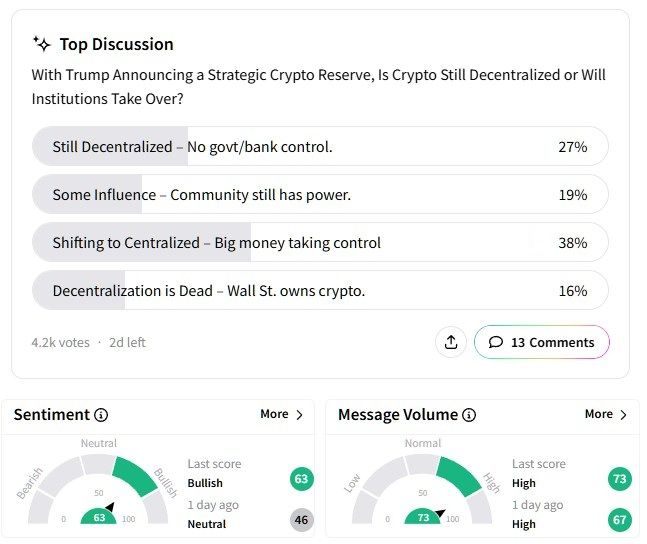

Despite the Trump administration's moves to revitalize the crypto industry, retail investors on Stocktwits think that this could adversely impact one of its core tenets: decentralization.

In a Stocktwits poll of more than 4,200 votes, 38% of the users said they think crypto is moving toward centralization, with big money taking over. Another 16% of users believe decentralization is already dead.

On the other hand, 27% of the votes insisted that crypto is still decentralized, while 19% think the community still has power.

Retail sentiment around Bitcoin flipped to enter the ‘bullish’ (63/100) territory from ‘bearish’ a day ago. Message volumes saw a spike, too.

One user quipped about the massive surge across the crypto sector.

Another user mocked Bitcoin bears.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)