Advertisement|Remove ads.

BITF, HIVE, IREN Surge As Bitcoin Mining Power Tops 1 Zetahash – WGMI ETF Hits Record High

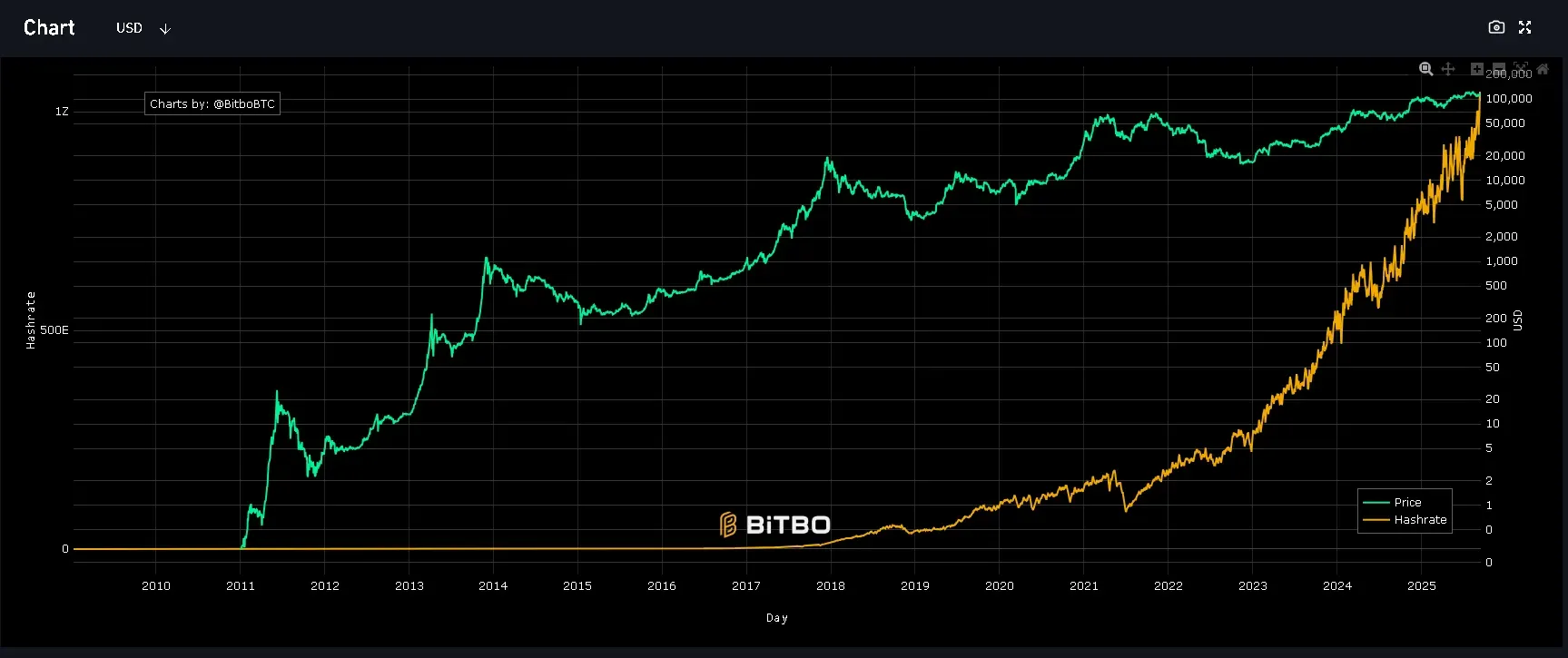

Shares of crypto mining companies, including Bitfarms (BITF), Hive Blockchain (HIVE), and IREN (IREN) climbed in morning trading on Monday after Bitcoin’s (BTC) hashrate crossed one zetahash per second over the weekend.

BITF’s stock jumped more than 14%, while Hive Blockchain’s stock gained 9%. Iren’s stock was up nearly 6%. On Stocktwits, retail sentiment around both Bitfarms and Hive Blockchain surged to ‘extremely bullish’ territory amid ‘extremely high’ levels of chatter over the past day. Retail sentiment around Iren’s shares trended in ‘bullish’ territory, accompanied by ‘high’ levels of chatter.

The Valkyrie Bitcoin Mining ETF (WGMI) hit a fresh record high, rising 2.8% in morning trade. The fund was changing hands near $38.83 after hitting a peak of $37.34 in the previous session. However, despite ‘high’ levels of chatter, retail sentiment remained in ‘bearish’ territory over the past day.

A zetahash equals one trillion exahashes and marks the total computing power securing Bitcoin’s Proof-of-Work (PoW) network. Hashrate is considered the backbone of Bitcoin security. The greater the computing power, the more resistant the network is to attacks or attempts to alter its ledger.

While a higher hashrate strengthens network security, it also increases mining difficulty. This tends to favor larger, well-capitalized firms with access to efficient hardware and low-cost energy, while putting pressure on smaller independent miners. This dynamic is likely to continue benefiting major players such as Bitfarms and Hive Blockchain, as they can scale operations efficiently, maintain margins, and expand production to meet growing network demands.

Read also: Dogecoin, Shiba Inu Slide After $2.4 Million Hack On Shibarium Ripples Through Crypto Market

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)