Advertisement|Remove ads.

BlackRock Stock In Spotlight As Investment Manager Plans Fresh Job Cuts: Retail's Bearish

Top asset manager BlackRock (BLK) is planning a second round of layoffs this year, according to a Bloomberg News report.

Citing people familiar with the matter, the report said the company intends to lay off around 300 employees, following a similar move announced in January.

The reductions would affect more than 1% of the company’s workforce. BlackRock had about 22,600 employees at the end of March.

As per the report, BlackRock’s employee count has grown by over 14% since 2023 following its acquisition of Global Infrastructure Partners and data firm Preqin Ltd.

In April, BlackRock stated that its employee compensation and benefits expense increased by 7% in the first quarter following the twin acquisitions.

BlackRock, which manages about $11.6 trillion in assets, had also agreed to buy private credit firm HPS Investment Partners for $12 billion in a bid to expand in a lucrative market that is growing at a rapid pace.

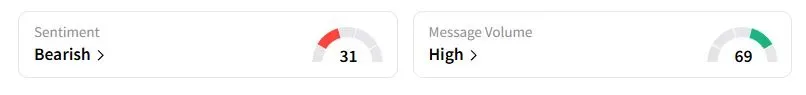

Retail sentiment on Stocktwits was ‘bearish’ (31/100) territory, while retail chatter was ‘high.’

Several other financial institutions on Wall Street have also resorted to job cuts to trim costs.

Morgan Stanley is reportedly laying off 2,000 employees, while Citi said earlier on Thursday it would cut 3,500 jobs in China.

BlackRock stock has fallen 4.3% this year amid tariff-driven economic uncertainty.

Earlier this week, Texas removed the asset manager from a boycott list after the firm scaled back several of it climate goals,.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_resized_jpg_ebb69683a4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210782271_jpg_55be798424.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stocks_fall_resized_jpg_f493534ad0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_zillow_resized_34b0642476.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)