Advertisement|Remove ads.

BlackBerry Stock Jumps After Wall Street Hikes Price Targets, But Remains Cautious: Retail’s Exuberant

Wall Street analysts raised their price targets on Canadian software and communications company BlackBerry Limited (BB) following a better-than-expected first-quarter earnings and a cheery outlook.

BlackBerry's first quarter (Q1) revenue declined 1.4% year-on-year (YoY) to $121.7 million, but still beat the consensus estimate of $112.18 million, as per Finchat data.

The adjusted earnings per share (EPS) of $0.02 also surpassed the consensus estimate of $0.

BlackBerry stock traded over 19% higher on Wednesday morning after the opening bell.

RBC Capital increased its price target on BlackBerry to $4 from $3.75 while maintaining a ‘Sector Perform’ rating, as per TheFly.

The research firm said the company’s Q1 results exceeded expectations, driven by stronger-than-anticipated revenue from Secure Communications and QNX. It noted that management remained cautious, reflecting ongoing uncertainty in the automotive sector and broader economic conditions.

Although BlackBerry is experiencing strong pipeline growth, RBC pointed out that visibility into auto production remains limited, and some new deals could face delays.

Baird increased its price target on BlackBerry to $5 from $4 while maintaining a ‘Neutral’ rating on the stock. The brokerage also noted that the outlook for QNX remains promising.

Canaccord raised its price target on BlackBerry to $4.60 from $4.25 and maintained a ‘Hold’ rating on the stock.

The research firm noted that BlackBerry's Q1 results significantly exceeded expectations, driven by strong performance in its IoT and QNX segment, which remains the company’s leading area.

Canaccord added that the overall business outlook has improved notably over the past year. It said the company’s streamlined strategic initiatives and solid adjusted EBITDA are expected to open up new opportunities for both organic growth and potential acquisitions.

On Monday, QNX, a subsidiary of BlackBerry and Vector announced the signing of a Memorandum of Understanding (MoU) to collaborate on creating a Foundational Vehicle Software Platform.

This next-generation solution aims to speed up the development of software-defined vehicles (SDVs) while simplifying the challenges of automotive software integration.

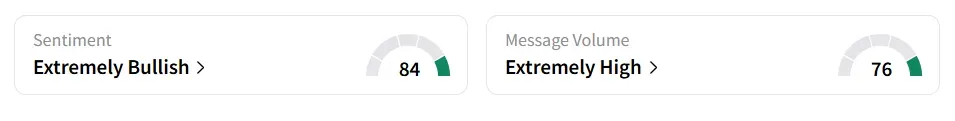

On Stocktwits, retail sentiment toward BlackBerry improved to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume also picked up the pace to ‘extremely high’ from ‘normal’ levels in the last 24 hours.

BlackBerry stock has gained over 38% year-to-date and more than doubled in the last 12 months.

Also See: Rubrik Acquires Predibase With Aim Of Slashing Costs By 80%, But Retail Remains Skeptical

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)