Advertisement|Remove ads.

Blacksky Technology Stock Rallies After Company Wins 8-Figure Multi-Year Contracts: Retail Gets More Bullish

Shares of Blacksky Technology Inc (BKSY) rallied on Thursday after the company said it had won multi-year contracts, including assured access to subscription-based low-latency, high-cadence imagery, and AI-enabled analytics services, and have a combined eight-figure value.

The company highlighted that the deals also include the delivery of one high-resolution Earth observation satellite and launch support operations and on-orbit maintenance services.

Blacksky explained that with subscription-based Assured access to its current high-cadence, real-time imagery, and analytics services, the customer has guaranteed access and first-priority tasking capacity over their national and regional areas of interest.

“Once operational, the high-resolution, electro-optical satellite will work in parallel to BlackSky’s dynamic monitoring constellation to deliver mission-relevant insights at industry-leading speeds,” the company stated.

CEO Brian O’Toole hinted that its customer is from India and said BlackSky’s combined offering will provide the country immediate foresight into critical events impacting the nation as it continues to expand its sovereign space capabilities over the next few years.

Earlier this month, the company said it won a multi-year contract from geospatial intelligence fusion company EMDYN. The agreement allows international ministries of defense to set up API-enabled automated tip-and-cue tasking and the fusion of signals and other intelligence sources to support real-time tactical operations.

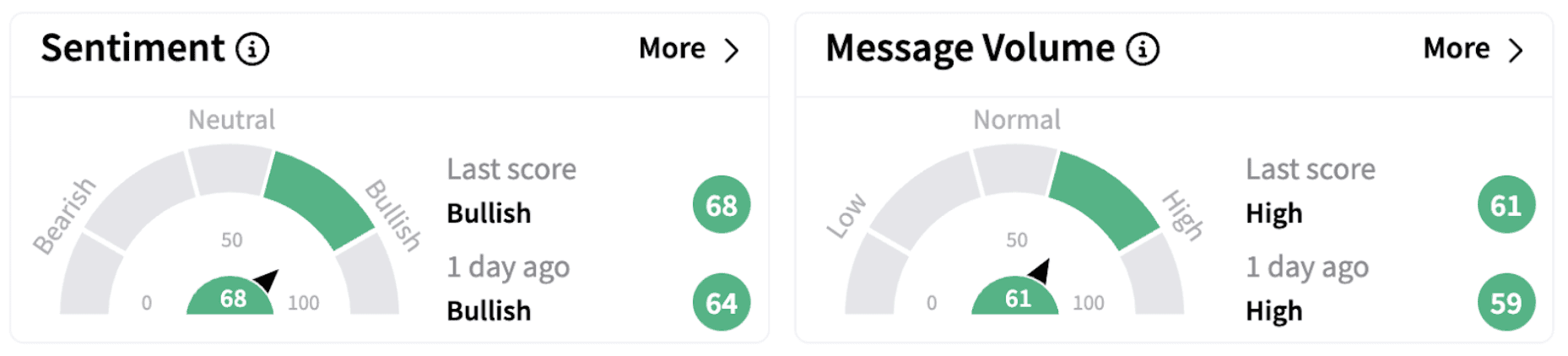

On Stocktwits, retail sentiment climbed further into the ‘bullish’ territory (68/100) accompanied by ‘high’ retail chatter.

Earlier this month, H.C. Wainwright raised the firm's price target on BlackSky to $20 from $12 while maintaining a ‘Buy’ rating on the shares.

According to TheFly, the brokerage said that as BlackSky continues to execute against its current strategy, the path to cash generation becomes clearer and will potentially attract new investors.

BKSY shares have gained 55% in 2025 and are up almost 48% over the past year.

Also See: Nano Nuclear Stock Rises On Inclusion In MSCI USA Index: Retail’s Not Impressed Yet

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)