Advertisement|Remove ads.

Sun Communities’ Stock Surges After Blackstone Agrees To Acquire Its Safe Harbor Marinas Business: Retail’s Unconvinced Yet

Shares of real estate investment trust Sun Communities Inc. (SUI) soared approximately 7% on Monday after Blackstone Inc. (BX) announced that funds managed by Blackstone Infrastructure will acquire Safe Harbor Marinas, a marina and superyacht servicing business in the U.S., for $5.65 billion.

Safe Harbor, which belongs to Sun Communities, owns and operates 138 marinas across the U.S. and Puerto Rico.

Sun Communities said the base purchase price represents an approximate 21x multiple on the estimated 2024 funds from operations of the Safe Harbor business.

The company expects to use the transaction proceeds to reduce debt, distribute dividends to shareholders, and reinvest in its core businesses.

Heidi Boyd, Senior Managing Director in Blackstone’s infrastructure business, said that Marinas benefit from key long-term thematic tailwinds, including the growth of travel and leisure and population inflows into coastal cities.

Sun Communities believes that following the deal closure, its North America manufactured housing (MH) and recreational vehicle (RV) portfolio is expected to account for approximately 90% of net operating income.

The company said the transaction meaningfully de-leverages its balance sheet as it expects its net debt to trailing 12 months earnings before interest, tax, depreciation, and amortization (EBITDA) to be reduced from approximately 6x to between 2.5x and 3.0x at closing.

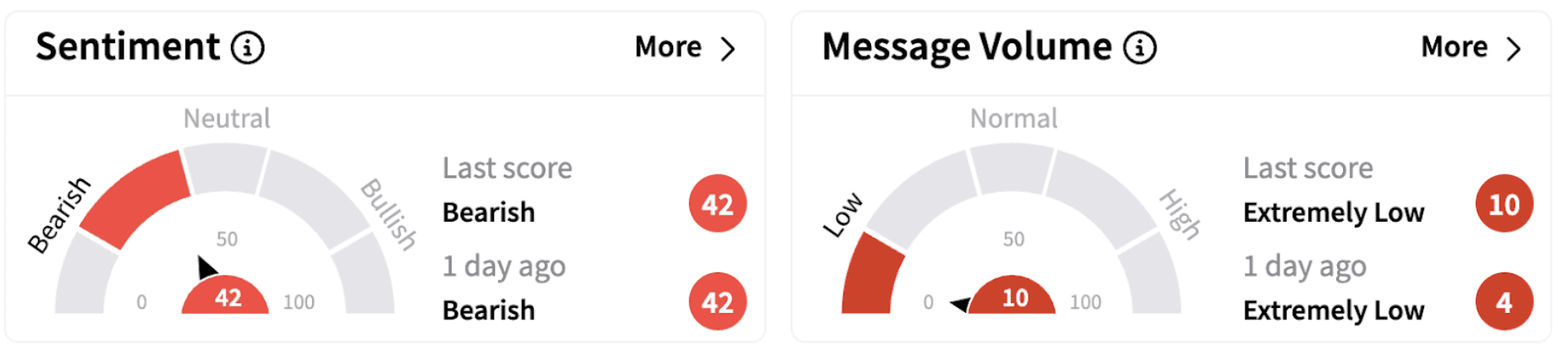

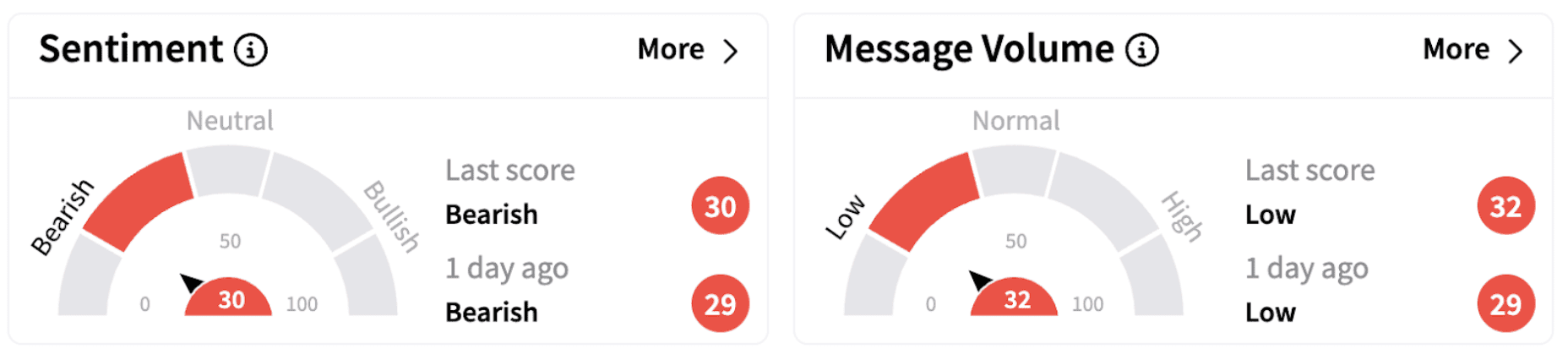

Despite the development, retail sentiment on Stocktwits continued to trend in the ‘bearish’ territory for both stocks.

Sun Communities’ shares have gained over 10% in 2025, while Blackstone’s shares have lost over 8% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)