Advertisement|Remove ads.

Block Stock Soars 6% On FDIC Nod For SFS’ Consumer Loan Product Ignoring Citi’s Price Target Cut — Retail Remains Neutral

Shares of financial services company Block Inc (XYZ) soared over 6% on Friday after the Federal Deposit Insurance Corporation approved the company’s industrial bank, Square Financial Services, Inc. (SFS), to begin offering the consumer loan product Cash App Borrow.

SFS offers business loans and interest-bearing business savings accounts through Square Loans and Square Savings.

Block said that SFS’s small, easy-to-repay consumer loans to Cash App customers will continue to empower consumers economically.

The firm highlighted that the short-term credit product is available to Cash App’s eligible customers.

Block said that SFS will commence servicing and originating Cash App Borrow loans in the coming weeks and gradually ramp up volumes over the coming quarters.

Meanwhile, Citi lowered its price target on Block to $90 from $108 while keeping a ‘Buy’ rating on the shares.

According to TheFly, the brokerage noted that product development and marketing investment should support a more favorable revenue growth profile, excluding Bitcoin into 2026, with a greater margin scale.

Citi also stated that although Block remains a "show me" story regarding Seller stabilization and greater Cash App monetization, the pullback in its shares "should provide an attractive entry point.”

On Thursday, BTIG analyst Andrew Harte kept a ‘Buy’ rating and a $110 price target on Block shares, citing the FDIC approval for Cash App Borrow consumer loans.

According to TheFly, the brokerage noted that the announcement is a prime example of the operational optionality that SFS brings to Block.

BTIG estimates the company is poised to grow its gross profit by about 15% over the next two years and rapidly expand operating margins as it continues to deepen relationships with Cash App users and Square merchants.

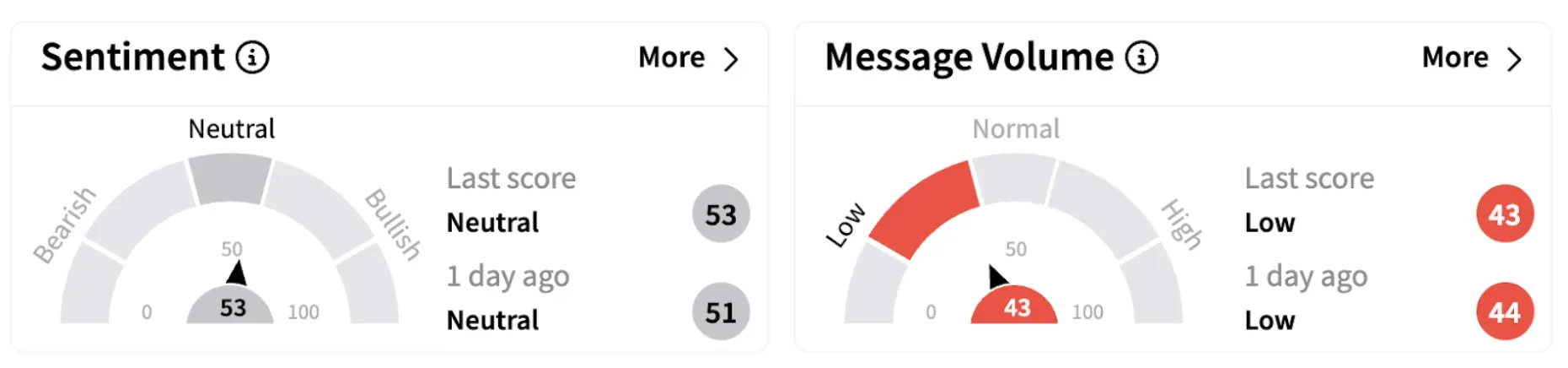

Meanwhile, retail sentiment on Stocktwits toward Block shares improved marginally but continued to trend in the ‘neutral’ territory (53/100), with subdued message volume.

Most Stocktwits user comments indicated a bullish take on the stock.

Block shares have lost over 33% in 2025 and are down over 29% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)