Advertisement|Remove ads.

BLS International Stock Sinks 18% After MEA Tender Ban; Technicals Signal Further Downside

Shares of BLS International tanked nearly 18% on Monday, after the Indian government banned the company from participating in future tenders of the Ministry of External Affairs (MEA) and Indian Missions abroad for two years.

BLS International shares fell as much as 17.9% to ₹276.95 on Monday, to their lowest since December 2023. The stock closed at ₹337.15 on Friday.

In a press release on Saturday, the company said that the “development does not impact the company’s current financials or ongoing operations. All existing contracts with Indian Missions across the globe remain valid and continue to operate as scheduled. Additionally, the order will not have any significant bearing on the company's financial outlook.”

In Q1FY26, Indian Missions contributed around 12% to the company’s consolidated revenue and about 8% to its EBITDA.

Over the past few years, the company secured new and renewed contracts with government and international clients across the United States, United Arab Emirates, Spain, Slovakia, Hungary, Poland, Portugal, and through the Unique Identification Authority of India (UIDAI) project in India.

The company also acquired iDATA and Citizenship Invest during the last financial year.

Technical Outlook

Technically, the stock has shown weakness after peaking at ₹521 on January 3, 2025, and slipping to ₹308 in March, noted SEBI-registered analyst Prabhat Mittal.

The stock has faced repeated resistance near ₹430 and took support around ₹316 in late September. Currently, the stock trades below all key moving averages, signalling bearish momentum, the analyst added.

Following the news, it broke the crucial ₹308 support level. Mittal recommends avoiding fresh positions unless the stock breaks and closes above ₹360, which could open targets near ₹420.

What Is The Retail Sentiment?

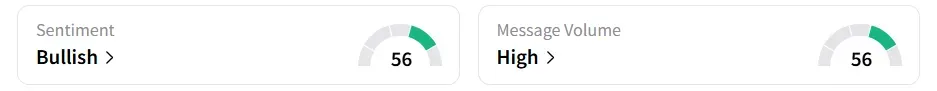

Despite the setback, retail sentiment on Stocktwits turned ‘bullish’, amid ‘high’ message volumes. It was ‘neutral’ a session earlier.

However, the stock has been under heavy selling pressure this year, declining 39%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)