Advertisement|Remove ads.

Bluejay Diagnostics Raises $3.7M Through Warrant Deal, Stock Slides After-Hours While Retail Interest Surges

Shares of Bluejay Diagnostics, Inc. (BJDX) garnered heavy attention among retail investors on Stocktwits late Monday after the company raised money through a warrant deal from institutional investors.

The stock, which more than doubled in the regular session, plunged nearly 50% in extended trading, with volume surging to more than 1,400 times its daily average.

The Acton, Massachusetts-based company said it had secured approximately $3.7 million in gross proceeds after institutional investors agreed to exercise existing warrants for 1,085,106 shares at a reduced price of $3.42 per share.

In return, the company issued new five-year warrants to purchase the same number of shares at the same price.

Bluejay said it conducted the transaction under a private placement exemption.

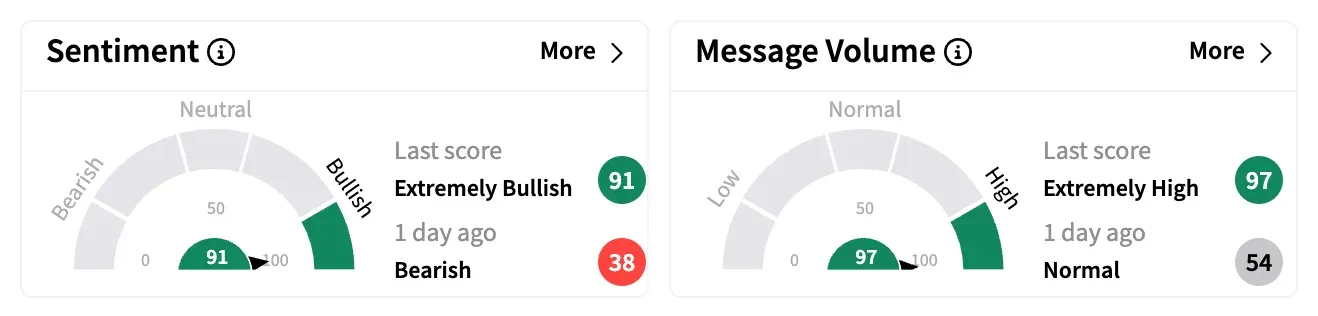

On Stocktwits, Bluejay was among the top trending tickers as of 9:40 pm ET, with retail chatter exploding by over 13,000% in the 24 hours to Monday evening.

Sentiment on the platform was ‘extremely bullish’ even as the stock was sliding in after-hours trading.

One optimistic watcher said long traders on the stock were bracing for it to nearly double to $10 or even go as high as $15, speculating that there could be “big news” around the corner.

Another expects the stock to retest the $5.25 level on Tuesday and said they would buy more if it drops below $3.50.

However, some users advised caution, given Bluejay’s low float of about 553,000 shares and the recent 1-for-50 reverse split in November.

Bluejay has shifted focus away from COVID-19-related applications due to declining hospitalizations.

It is now developing rapid, whole-blood tests on its patented Symphony platform, which includes a handheld device and single-use cartridges. Bluejay's lead product, the IL-6 test, targets inflammation and sepsis monitoring. The company recently completed a pilot study and plans to launch a follow-up trial to support FDA clearance.

However, Bluejay said in November that it anticipates delays in submitting its FDA application within the next 18 months due to ongoing technical issues with its cartridge system.

The company also expressed substantial doubt about its ability to continue as a going concern in 2025, citing the need for additional capital.

Bluejay’s stock has gained over 60% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_charles_hoskinson_OG_jpg_7eaff6116d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Dimon_July_b5bbf1a09d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)