Advertisement|Remove ads.

Boeing Secures $35B Financing to Tackle Production Delays and Cash Flow Woes, But Retail Stays Bearish

Shares of Boeing Co (BA) rose over 1% in Tuesday’s pre-market session after the firm announced fresh financing aimed at strengthening its financial position in the face of ongoing production delays caused by striking workers.

The aerospace giant recently secured a $10 billion supplemental credit agreement with major financial institutions to provide immediate liquidity. Additionally, Boeing filed plans to raise up to $25 billion through a mixed securities shelf, which gives further flexibility to raise capital as needed.

A "mixed securities shelf" allows the company flexibility in the types of securities it can issue over time, including but not limited to stocks and bonds.

Boeing’s shares were downgraded to ‘Hold’ by DZ Bank with a price target of $152. Citi has also lowered the firm’s price target to $209 from $224 but maintains its ‘Buy’ rating on the stock. According to the analysts, Boeing's plans to cut its staff down by 10% “is the beginning of a long pruning process.. as it looks to streamline and become more manageable.”

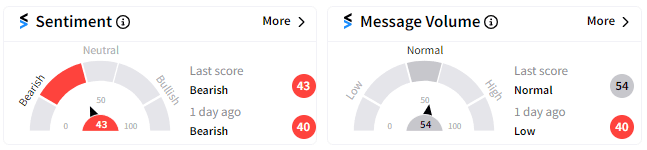

Retail sentiment on Stocktwits remains in the ‘bearish’ (43/100) territory even though chatter seems to have returned to ‘normal’ (54/100) from ‘low.’

Despite these financial maneuvers, Boeing continues to face significant challenges. Around 33,000 of its workers have been on strike since September, and according to S&P Global, this labor stoppage is costing Boeing an estimated $1 billion per month.

The financial strain from these disruptions is compounding the company’s already complex issues, including production delays that have frustrated key customers like Emirates. The airline, along with others, has expressed dissatisfaction over repeated delays in the delivery of aircraft.

For updates and corrections email newsroom@stocktwits.com.

Read More: Boeing's Stock Drops Amid Workforce Cuts And Wall Street Doubts: Retail Sentiment Split

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)