Advertisement|Remove ads.

Boeing's Stock Drops Amid Workforce Cuts And Wall Street Doubts: Retail Sentiment Split

Shares of Boeing Co (BA) were down as much as 2% pre-market on Monday as the company continues to face one crisis after another. The plane maker, whose shares have slipped 5% in the last month, seems to be in for another rough week laden with bad news before the markets have even opened.

In addition to concerns about a potential junk credit rating and the ongoing mechanists’ strike, Boeing is planning significant workforce reductions.

The company also announced its preliminary third-quarter results late Friday, which included a five-year delay in the delivery of its 777X plane, leading to dissatisfaction from key customer Emirates on Monday.

Wall Street sentiment has soured as well, with both JP Morgan and Wells Fargo lowering their price targets for the stock.

According to the Financial Times, Boeing plans to reduce its staff by 17,000, or approximately 10% of its workforce, over the coming months, affecting executives, managers, and employees alike.

Boeing CEO Kelly Ortberg reportedly told employees that “restoring our company requires tough decisions” to ensure that Boeing “can stay competitive and deliver for our customers over the long term.”

Meanwhile, the world’s largest airline and one of Boeing’s primary customers, Emirates, isn’t happy that the delivery of the 777X model will be delayed again. Boeing announced on Friday that the first delivery of its largest widebody model will be delayed to 2026, more than five years after the giant plane was originally set to reach customers.

“Emirates has had to make significant and highly expensive amendments to our fleet programs as a result of Boeing's multiple contractual shortfalls. I fail to see how Boeing can make any meaningful forecasts of delivery dates,” Emirates President Tim Clark said in a statement.

Wall Street has turned cautious on Boeing following its underwhelming preliminary third-quarter results. Wells Fargo lowered its price target to $109 while maintaining an 'Underweight' rating, and JP Morgan cut its target from $195 to $235 with an 'Overweight' rating, citing uncertainties in Boeing’s forecasts and potential cash burn in 2025.

Concerns also linger around Boeing's $4 billion debt due next year, with JP Morgan predicting a possible $15 billion equity raise. TD Cowen also trimmed its price target to $190, attributing Boeing’s large Q3 loss to the new CEO’s strategic reset.

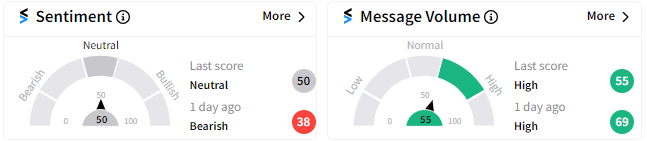

Retail sentiment on Stocktwits has marginally improved to ‘neutral’ (50/100) from ‘bearish’ a day ago. Users on the platform are divided over whether the cost-cutting measures announced by Boeing will be enough to keep the company afloat.

For updates and corrections email newsroom@stocktwits.com.

Read more: Boeing Shares Tumble Amid Stalled Negotiations and Downgrade Fears: Retail Sentiment Sours

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)