Advertisement|Remove ads.

Boeing Shares Tumble Amid Stalled Negotiations and Downgrade Fears: Retail Sentiment Sours

Shares of Boeing Co (BA) were trading lower by over 2% on Wednesday amid fears of a rating downgrade and another failed attempt at negotiations with its workers, who have been on strike since mid-September.

The breakdown of talks between the company and its key manufacturing union further compounds Boeing’s existing financial and production problems. According to S&P Global Ratings, the strike is costing Boeing over $1 billion a month, putting its “recovery at risk”. The ratings agency is currently looking at downgrading Boeing’s credit grades to junk.

Boeing is reportedly looking to raise funds through sale of stock and equity-like securities to raise the billions of dollars it needs and shore up its balance sheet. Sources told Reuters that the company has received pitches from multiple investment banks, including JPMorgan and Goldman Sachs, on its options.

However, both Wall Street and retail investors don’t see brighter pastures ahead for the global commercial plane-maker. Boeing’s stock has lost 40% of its value in 2024 so far, with a 7% fall in the last month itself.

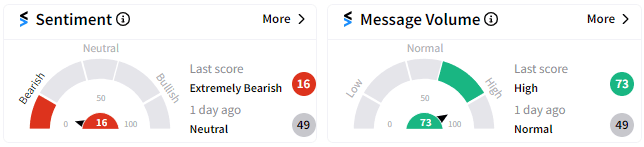

Retail sentiment on Stocktwits took a nose-dive into ‘extremely bearish’ (16/100) territory from ‘neutral’ (49/100) a day ago. Investors aren’t happy with the turn things are taking, apparent from the high chatter, with message volume shifting to ‘high’ (70/100) from ‘neutral’ (49/100) a day ago.

The stand-off adds to the challenges faced by Boeing's new chief executive Kelly Ortberg, who was appointed in August with a mission to turn the business around. The company has also introduced temporary furloughs for thousands of salaried employees, while the factories producing its best-selling 737 MAX and its 767 and 777 planes are shut to manage costs.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)