Advertisement|Remove ads.

Boeing Plans To Ramp Up 737 MAX Output Within This Month: Report

Boeing (BA) has reportedly informed suppliers that it plans to increase the production rate of its best-selling 737 MAX jets to 42 per month as early as this month.

According to a Bloomberg News report, citing people familiar with the matter, Boeing is also laying the groundwork to ramp up output again in April and once more in late 2026. The report stated that the step changes could boost production to about 53 jets per month by the end of next year.

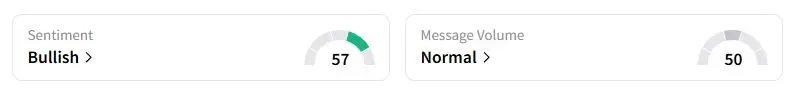

Retail sentiment on Stocktwits about Boeing was in the ‘bullish’ territory at the time of writing.

However, the report also stated that internal planning helps suppliers line up equipment and resources, and is not set in stone.

Boeing reportedly intends to maintain a 42 jets-per-month pace for about six months, ensuring its mechanics and suppliers aren’t overly stressed by building an additional 737 a week, before approaching the FAA about the subsequent increase in production.

The rise in output will be a much-needed boost for Boeing, which has been on a loss-making spree since last year due to fallout from a midair incident involving a 737 MAX aircraft. The mishap led to increased regulatory scrutiny and a 38-per-month cap on production of the plane by the Federal Aviation Administration.

The company also had to grapple with a crippling strike at its facility in Renton, Washington, which further added to its debt burden. However, the company is slowly making a turnaround under CEO Kelly Ortberg and has already hit the 38-per-month ceiling during the second quarter.

Last month, Ortberg stated during a conference that regulators and the company considered six key performance indicators to track the stability of the production system, and one of them was performing slightly under par. However, he was confident about getting the FAA nod to boost output to 42 by the end of the year.

A key hurdle for Boeing to maintain production rates at about 50 or above could be the supply of engines, which has also prevented rival Airbus from reaching its more ambitious goals for its A320-family of jets.

Boeing’s stock has gained 21.3% this year. Last week, another report stated that the first commercial flight of its long-delayed 777X model will take place in 2027, rather than next year, which will add to its cash flow constraints.

Also See: Freeport-McMoRan Confirms All 7 Missing Grasberg Workers Found Dead After Mud-Flow Disaster

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244842667_jpg_931c352b95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)