Advertisement|Remove ads.

Woodside Energy In Spotlight After 40% Stake Sale In Louisiana LNG, Retail’s Bullish

Woodside Energy (WDS) stock drew retail investor attention after the company agreed to sell a 40% stake in its Louisiana LNG project to the U.S.-based investment firm Stonepeak.

Under the deal terms, Stonepeak will provide $5.7 billion for the development of Louisiana LNG on an accelerated basis, contributing 75% of project capital expenditures in 2025 and 2026.

The deal is expected to close in the second quarter.

Woodside had bought Louisiana LNG through its $900 million acquisition of U.S.-listed Tellurian last year. The project has a total permitted capacity of 27.6 million tonnes per annum.

“This transaction further confirms Louisiana LNG’s position as a globally attractive investment, set to deliver long-term value to our shareholders. It is the result of a highly competitive process that attracted leading global counter-parties and significantly reduces Woodside’s capital expenditure for this world-class project,” Woodside CEO Meg O’Neill said.

Woodside said it will continue advancing discussions with additional potential partners, targeting an equity sell-down of around 50% in the integrated project.

The Australian firm’s financial advisers were RBC Capital Markets and Evercore.

Several analysts have said that demand for U.S. LNG could spike as countries look to cut their trade deficit with the U.S. by buying more energy amid tariff concerns.

The U.S. is already the world’s top LNG exporter, and several projects are slated to come online by the end of the decade.

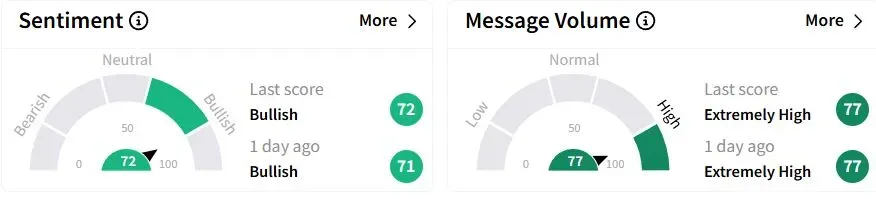

Retail sentiment on Stocktwits remained in the 'bullish'(72/100) territory, while retail chatter remained was 'extremely high.'

One retail trader said the stock is poised for a bounce-back at current levels.

Woodside shares have fallen 26% year-to-date (YTD).

Its Australia-listed shares were down amid broader market declines.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263711678_jpg_7dcbe85e4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263736058_jpg_2b8f901978.webp)