Advertisement|Remove ads.

Boeing Stock Slides On Fresh 777X Woes, Retail Investor Optimism Wanes

Shares of Boeing Co. (BA) fell over 4% on Tuesday, dragging retail sentiment down, after the company revealed a new hurdle in its efforts to certify the 777X, its newest widebody jet.

Boeing reportedly grounded its entire 777X test fleet after discovering a damaged thrust link, a key engine mounting structure, on a 777-9 during routine maintenance. This failure signifies a critical design flaw, causing delays in the already-behind-schedule certification process.

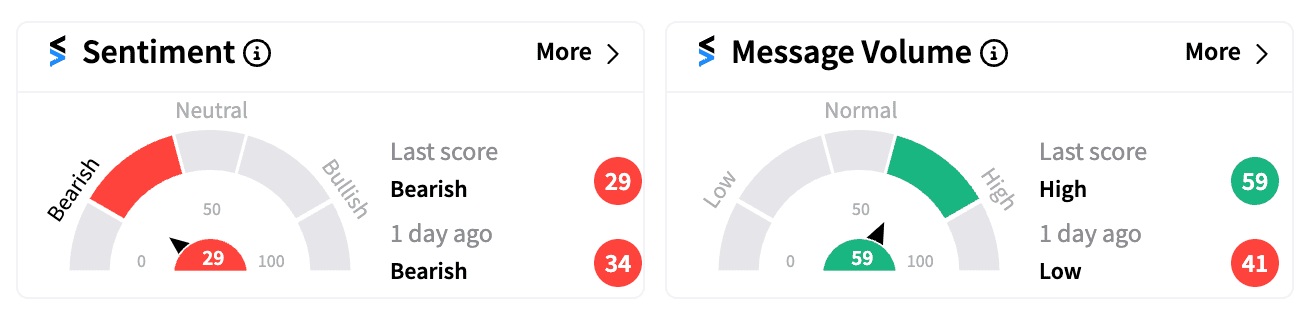

Following the news, retail investor sentiment on Stocktwits shifted deeper into ‘bearish’ territory (29/100), with a significant increase in message volume.

Some users expressed concerns about Boeing's competence and potential regulatory issues stemming from this incident.

This development presents the first major challenge for Boeing's new CEO, Kelly Ortberg, who took charge earlier this month and boosted investor sentiment.

RBC Capital analyst Ken Herbert reportedly expects the grounding to push 777x delivery expectations “to the right, and potentially into 2026,” adding that the program’s approval period would likely be prolonged.

Boeing has faced a series of issues in recent years, including fatal crashes, production problems, and safety incidents.

However, August has presented a few positive catalysts, such as increased orders and deliveries for the previous month, a major aircraft order from EL AL Israel Airlines, and reports of potential freighter deals with Saudi Arabia.

Despite the recent setbacks, Boeing's stock price is still up over 1% since Ortberg took over, suggesting the broader market retains some confidence in his leadership.

However, retail investors are turning cautious, worried about potential regulatory fallout and further delays impacting the 777X program.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)