Advertisement|Remove ads.

Boise Cascade Stock Slips Aftermarket As Q4 Profit Falls Nearly 30%: Retail Shrugs It Off

Boise Cascade Co (BCC) shares edged lower after the bell on Thursday as the company’s fourth-quarter profits declined 29% from a year earlier.

The wood products firm posted a fourth-quarter net income of $68.90 million, or $1.78 per share, compared with $97.56 million, or $2.44 per share, in the year-ago period.

The company’s reported quarterly revenue fell 5% to $1.57 billion. It was roughly in line with estimates.

“As we look forward to 2025, uncertainties surrounding the economy and residential construction activity will heavily influence the demand environment,” CEO Nate Jorgensen said.

Its Wood Products segment sales, including sales to Building Materials Distribution (BMD), fell by 7% to $419.7 million, driven by lower sales prices for laminated veneer lumber (LVL), I-joists, and plywood, which are used in construction.

However, LVL and plywood sales volumes grew 11% and 2%, respectively.

The company said its BMD segment sales fell 4% to $1.44 billion, driven by a 2% decrease in both sales price and volume.

“We expect 2025 to reflect modest growth in home improvement spending, as the age of U.S. housing stock, elevated levels of homeowner equity, and recent improvement in existing home sales will provide a favorable backdrop for repair-and-remodel spending,” the company said.

The company projected capital expenditures in 2025, excluding potential acquisition spending, to be between $220 million and $240 million.

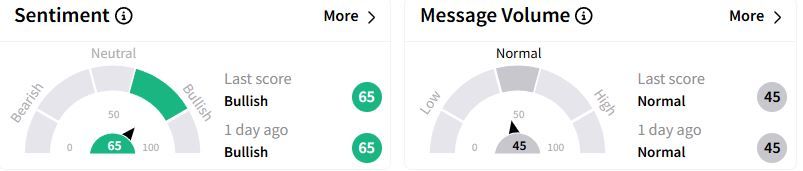

Retail sentiment on Stocktwits remained in ‘bullish’ (65/100) territory, while retail chatter stayed ‘normal.’

Over the past year, Boise Cascade shares have fallen 12%.

Also See: Fidelity National Financial Stock Gains Aftermarket On Upbeat Q4 Profit, Retail Stays Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)