Advertisement|Remove ads.

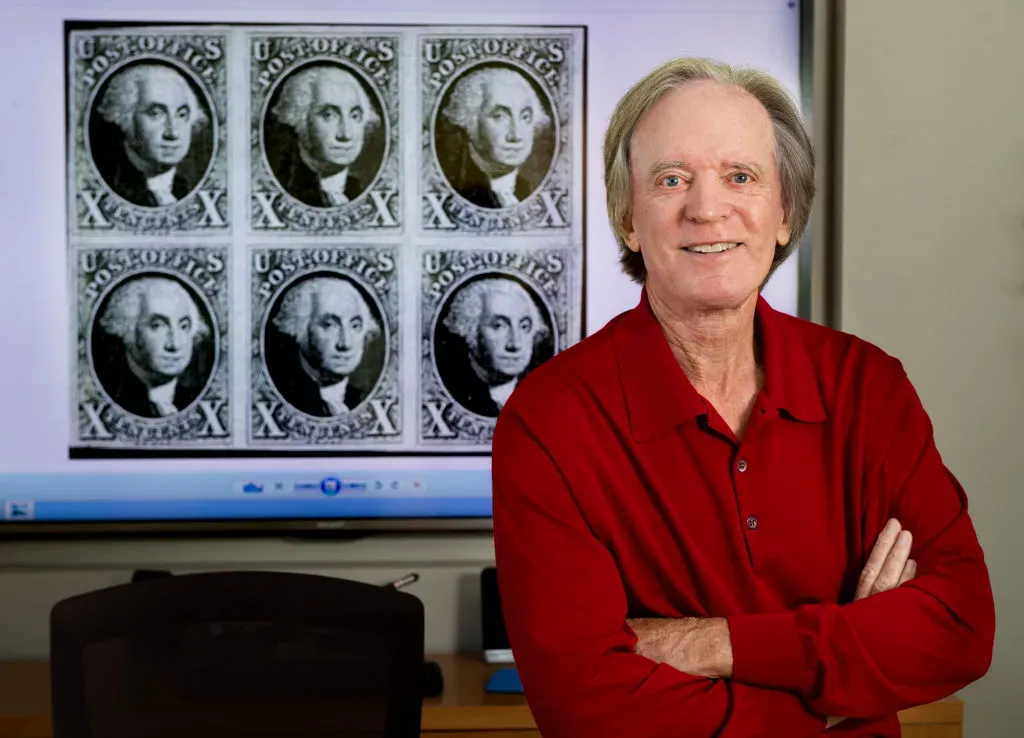

Bond King Bill Gross Reportedly Warns Stock Market Rally Needs New Fuel To Keep Going

- Gross pointed to early‑year volatility as evidence that the market’s advance is not as sturdy as it once appeared.

- He cited the possibility of interest rate cuts, continued evidence that AI boosts productivity as potential stabilizers.

- The investor also raised concerns about high market valuations.

Famed investor Bill Gross, known as “Bond King,” has reportedly warned that risks tied to lofty valuations and broader economic concerns could blunt the stock market gains seen over the past few years.

According to a Business Insider report, Gross warned that the long stock market rally may be losing steam and needs fresh catalysts to stay on track as 2026 unfolds.

Concerns About Momentum

Gross pointed to early‑year volatility as evidence that the market’s advance is not as sturdy as it once appeared. Despite the S&P 500’s strong run largely fueled by Big Tech and artificial intelligence excitement, which helped lift the benchmark roughly 80% over three years, recent swings between gains and drops have signaled potential fragility, the report stated.

In his view, the market is like a runner needing support rather than sprinting ahead with confidence.

What Could Help Markets?

According to the report, Gross said several factors could bolster stocks if they materialize. He cited the possibility of interest rate cuts, continued evidence that AI boosts productivity, and sustained double‑digit earnings growth as potential stabilizers.

"Lower interest rates would help, as would continued news that AI actually results in higher productivity, and continuing 15% plus earnings gains," Gross added.

He also raised caution about high market valuations, noting measures such as the Buffett Indicator, which compares stock prices to economic output, sit near extreme levels. Such rich pricing, he argued, could dampen future returns as markets adjust to fundamentals.

Echoes From Other Investors

Gross’s caution reflects themes similar to those voiced by other market watchers. For example, Michael Burry has emphasized that elevated stock prices may suppress future returns, while Jeremy Grantham has warned that record valuations could mean lower performance ahead even if prices stay high.

However, optimists like Dan Ives, managing director at Wedbush Securities, have predicted that tech stocks could surge by 20% to 25% in 2026. Ives said that it’s not just about Big Tech stocks in 2026; other players in the industry stand to benefit as well.

The retail sentiment toward the SPDR S&P 500 ETF (SPY), an exchange-traded fund that tracks the S&P 500 Index, stayed in ‘bearish’ territory, and the Invesco QQQ Trust (QQQ) ETF, which tracks the Nasdaq 100 Index, remained in ‘bearish’ territory as well.

Also See: What’s Driving RVYL Stock’s Rally This Week?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)