Advertisement|Remove ads.

Box Stock Slides Premarket After In-Line Q4, Weak Guidance: Retail Stays Bullish

Box, Inc. (BOX) shares retreated in Wednesday’s premarket trading after the content management platform provider reported in-line quarterly results and issued subpar guidance for the current quarter and the fiscal year 2026.

The Redwood City, California-based company reported adjusted earnings per share (EPS) of $0.42 for the fourth quarter of the fiscal year 2025, flat with the year-ago number. The company said unfavorable forex impact dented the bottom line by $0.03.

The metric aligned with the Finchat-compiled consensus and beat Box’s guidance by a penny.

Quarterly revenue climbed 6% year over year (YoY) to $279.5 million versus the consensus of $279.20 million and the guidance of $279 million.

Box co-founder and CEO Aaron Levie said the fiscal year 2025 was pivotal for the company. He said, “We delivered our strongest set of AI-powered innovations and launched Enterprise Advanced, integrating the full capabilities of our platform into one solution.”

Levie said the company is developing an Intelligent Content Management platform that will transform unstructured data into actionable information, empowering businesses to take advantage of this critical opportunity.

Among operational metrics, remaining performance obligations (RPOs) rose 12% YoY to $1.466 billion compared to the 13% growth in the third quarter.

Billings improved 5% to $398.6 million, faster than the 4% growth last quarter. Box noted a 150-basis point (bps) forex headwind worse than the 80 bps it had previously factored in.

The company expects first-quarter adjusted EPS of $0.20 to $0.26 and revenue of $274 million to $275 million, missing the consensus estimates of $0.28 and $275.62 million, respectively.

Box forecasts fiscal year 2026 adjusted EPS of $1.13-$1.17 and revenue of $1.155 billion to $1.160 billion. Analysts, on average, estimate $1.34 and $1.157 billion, respectively.

The earnings guidance for the first quarter and the full year included negative impact stemming from unfavorable forex rates and the recognition of non-cash deferred tax expenses.

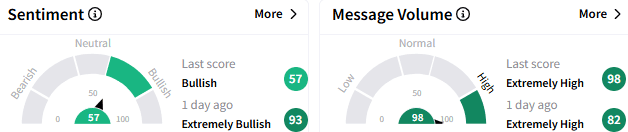

On Stocktwits, retail sentiment toward Box stock tempered to ‘bullish’ (57/100) from the ‘extremely bullish’ mood that prevailed a day ago. The message volume remained ‘extremely high.’

A bullish watcher recommended buying the dip in Box stock, expecting it to rise to $40.

Another user said they saw no issue with the earnings report or impact from President Donald Trump’s tariffs.

In premarket trading, Box stock fell 6.21% to $31.39. It has gained about 6% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)