Advertisement|Remove ads.

BP Stock In Spotlight After Report Says Elliott Acquires About $5B Stake, Aims To Push For Asset Sales: Retail Mood Brightens

BP Plc (BP) stock garnered retail attention premarket on Thursday after a report said activist investor Elliott has taken up a nearly $5 billion stake in the company and would push for asset sales.

A Financial Times (FT) report said Elliott’s £3.8 billion ($4.74 billion) stake has made it the third largest investor in the British oil major.

The report said that the near-5% stake could include shares and derivative positions that replicate an economic interest in the stock, citing two people familiar with the matter.

Over the past few years, BP’s shares have lagged behind rivals such as Exxon, Chevron, and Shell.

Under former CEO Bernard Looney, BP emphasized renewable energy based on a miscalculated bet that oil demand had already peaked by 2020.

The FT report said Elliott considers it a ‘poor use of capital’ and that BP should cap future spending on renewables and sell off several of its assets.

Present BP CEO Murray Auchincloss has focused on oil and gas investments and slowed down some renewable energy operations.

Auchincloss promised a fundamental strategy reset earlier this week, and he is expected to unveil it on Feb. 26 at the company’s Capital Markets Day.

Elliott reportedly expects to see an aggressive chair supported by an engaged board pushing for the reset.

The activist investor's campaign is being run by John Pike and Gaurav Toshniwal. According to the FT report, Pike has previously run several campaigns in US oil companies such as Hess and Marathon, Canadian oil sands producer Suncor, and refiner Phillips 66.

On Tuesday, BP missed fourth-quarter earnings estimates on weak refining margins and projected a decline in upstream production in 2025.

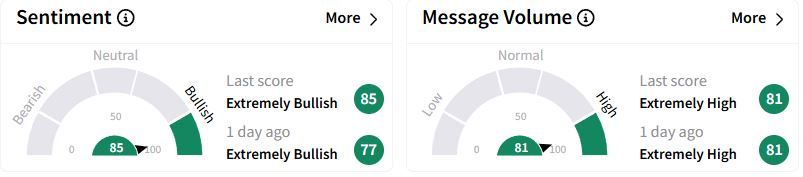

Retail sentiment on Stocktwits moved higher into the ‘extremely bullish’ (85/100) territory than a day ago, while retail chatter was ‘extremely high.’

Over the past year, BP’s U.S. shares have fallen 4.6%.

Also See: Deere & Co Stock Slips Premarket After Q1 Earnings Slump: Retail Stays Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)