Advertisement|Remove ads.

BP Stock Falls Premarket After Q4 Profit Miss: Retail Shrugs It Off

BP Plc (BP) stock fell 0.9% in premarket trade on Tuesday after the oil major’s fourth-quarter earnings missed analyst estimates.

The London-based company’s underlying replacement cost profit fell to $1.17 billion, compared with $2.99 billion in the year-ago quarter.

CNBC reported, citing LSEG data, that analysts, on average, expected the company to post a profit of $1.2 billion.

The company attributed the decline to weaker realized refining margins, higher impact from maintenance activity, seasonally lower customer volumes, and fuel margins.

Its peers Chevron and Exxon also posted declines in refining revenue during the fourth quarter. Global refining margins have slumped following a rise in production capacity in Asia and Africa amid lukewarm fuel demand.

BP’s reported production for the quarter was 850,000 barrels of oil equivalent per day, 5.4% lower than the same period in 2023.

“We now plan to fundamentally reset our strategy and drive further improvements

in performance, all in service of growing cash flow and returns,” said CEO Murray Auchincloss.

The company is scheduled to hold its capital markets day on Feb. 26.

The energy firm expects first-quarter reported upstream production to be lower than the fourth quarter of 2024, primarily due to previously announced divestments in Egypt and Trinidad.

The company said divestment and other proceeds would be around $3 billion in 2025, weighted towards the second half.

BP projected full-year production to be lower than in 2024, with oil production remaining roughly flat and declining gas and low-carbon energy output.

The company said it intends to buy back shares worth $1.75 billion before reporting the first quarter results.

The results come days after reports said activist investor Elliott Investment Management had taken a significant stake in the company.

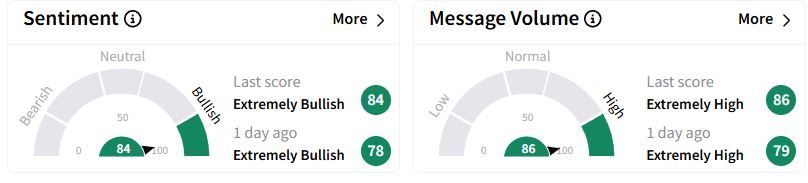

Retail sentiment on Stocktwits remained in ‘extremely bullish’ (84/100) territory from ‘neutral’(78/100) a day ago, while retail chatter remained ‘extremely high.’

Over the past year, BP’s U.S.-listed shares have fallen 5.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243572319_jpg_90770a5e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)