Advertisement|Remove ads.

Deere & Co Stock Slips Premarket After Q1 Earnings Slump: Retail Stays Bearish

Deere & Co (DE) stock was down 5.2% premarket on Thursday after the company’s first-quarter net income fell 50% compared to last year.

The farm equipment maker reported a net income of $869 million, or $3.19 per share, for the first quarter, compared to $1.75 billion, or $6.23 per share, last year.

Its quarterly net sales declined by 30% to $8.51 billion compared to the year-ago quarter but topped a Wall Street estimate of $7.90 billion, according to KoyFin data.

Deere said that sales in its production and precision agriculture segment decreased by 37% to $3.67 billion for the quarter, while sales in the small agriculture and turf segment fell by 28%.

According to the U.S. Department of Agriculture, farm income declined in 2024 due to higher interest rates and lower crop prices. Analysts fear a fresh tariff war would further raise crop production costs and weigh in on farmers’ earnings.

Deere also said its construction and forestry segment sales fell 38% to $1.99 billion.

The company reaffirmed its fiscal 2025 profit forecast between $5 billion and $5.5 billion.

The Illinois-based company expects fiscal 2025 net sales in its production and precision agriculture segment, including tractors and combine harvesters, to decline between 15% and 20%. It had earlier projected a fall of 15%.

Deere added that its outlook does not include the impact of tariffs.

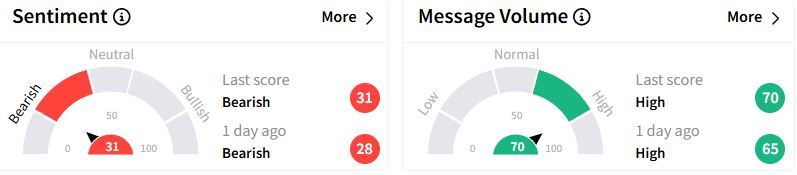

Retail sentiment on Stocktwits remained in the ‘bearish’ (31/100) territory, albeit with a higher score than a day ago. Retail chatter on the stock was ‘high.’

The company unveiled several autonomous machines last month, which would not require a human in the driver’s seat, amid a shortage of skilled workers in agriculture.

Over the past year, Deere stock has gained 24%.

Also See: Spirit Airlines Rejects New Merger Offer From Frontier: Retail’s Optimistic About A Deal

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)