Advertisement|Remove ads.

Honeywell To Split Into 3 Listed Entities Months After Elliott Management’s $5B Stake Buy: Retail Holds Back For Now

Honeywell announced on Thursday it intends to split the company into three separate publicly listed entities by the second half of 2026 in a manner that will be tax-free to shareholders. The decision comes months after activist investor Elliott Investment Management took a $5 billion stake in the firm.

The three entities—Honeywell Automation, Honeywell Aerospace, and Advanced Materials— will have distinct strategies and growth drivers.

Honeywell Automation will be a pure-play automation player with a comprehensive portfolio of technologies, solutions, and software to drive customers’ productivity. In 2024, it posted revenues of $18 billion.

Honeywell Aerospace will be a premier technology and systems provider. It reported $15 billion in annual revenue in 2024.

Meanwhile, Advanced Materials' spin-off was announced earlier. The company will provide sustainability-focused specialty chemicals and materials. It reported nearly $4 billion in revenue last year.

Honeywell highlighted that the three independent companies will be appropriately capitalized to take advantage of future growth opportunities. At the same time, Honeywell Automation and Honeywell Aerospace are each expected to maintain a strong investment-grade credit rating.

CEO Vimal Kapur said the firm has a rich pipeline of strategic bolt-on acquisition targets and plans to continue deploying capital to enhance each business. "As Aerospace prepares for unprecedented demand in the years ahead across both commercial and defense markets, now is the right time for the business to begin its own journey as a standalone, public company," Kapur said.

Elliott Partner Marc Steinberg and Managing Partner Jesse Cohn said the enhanced focus, alignment, and strategic agility enabled by this separation will allow Honeywell to realize the opportunity for operational improvement and valuation upside.

“We look forward to continuing to support Vimal and the management team as they execute on the separation and deliver significant long-term value to Honeywell’s shareholders,” they stated in prepared remarks.

However, Honeywell shares traded over 2% lower in Thursday’s pre-market session as the company’s full-year revenue and earnings guidance fell short of Wall Street estimates.

Honeywell expects 2025 sales to be $39.6 billion—$40.6 billion, compared to an analyst estimate of $41.26 billion. The company expects full-year adjusted earnings per share (EPS) at $10.10 - $10.50, compared to a Wall Street estimate of $10.91.

For the quarter ending Dec. 31, 2024, Honeywell reported a 7% year-over-year (YoY) rise in net sales to $10.09 billion compared to a Wall Street estimate of $9.83 billion. Adjusted EPS stood at $2.47 versus an estimated $2.32.

Honeywell said that despite ongoing macroeconomic challenges, its backlog grew 11% to a record $35.3 billion.

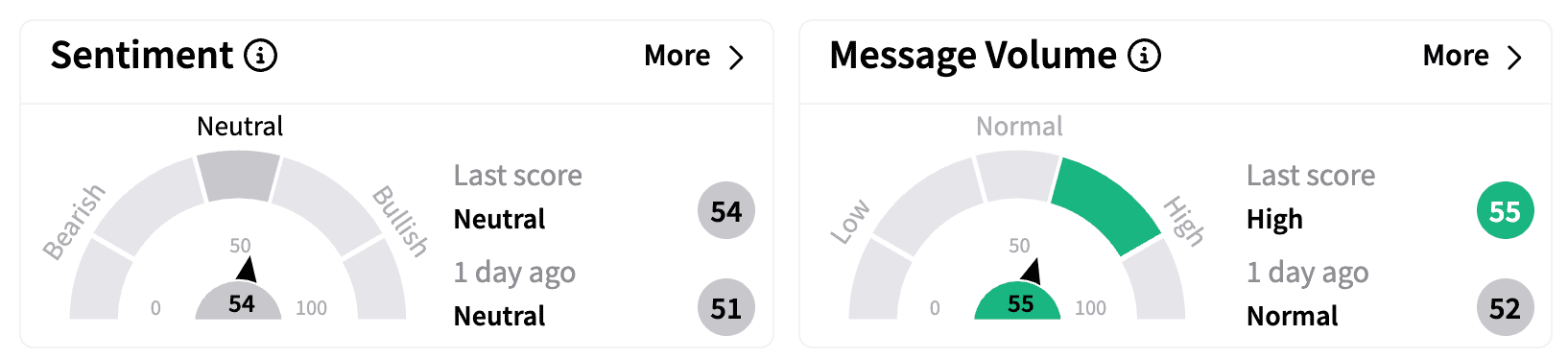

On Stocktwits, retail sentiment continued to trend in the ‘neutral’ territory (54/100).

Some Stocktwits users expressed hope the stock will gain in the near term.

Honeywell shares have lost over 1% in 2025 but are up over 14% over the past year.

Also See: Symbotic Stock Dives 17% Pre-Market After Q1 Earnings Miss: Retail Eyes Bottom Fishing Opportunity

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1238223992_jpg_be616a7919.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229019912_jpg_3e9bff3d29.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crowdstrike_resized_jpg_6549f7641a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2071907975_jpg_85e059f13e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)