Advertisement|Remove ads.

Breakout Radar: LTI Mindtree, Persistent, Cholamandalam Finance Show Bullish Setups

Analysts have turned bullish on select IT and financial names, flagging potential breakouts in LTI Mindtree, Persistent Systems, and Cholamandalam Investment & Finance. Technical charts across these stocks signal renewed upside, supported by volumes.

Let’s take a look at their breakout recommendations:

LTI Mindtree

Analyst Financial Sarthis expects a breakout in LTI Mindtree, with a volume spike for conviction. A close above ₹5,610 could take the stock higher to ₹5,900. They added that the stock has tested crucial resistance multiple times, and is now poised for a breakout once volumes support it.

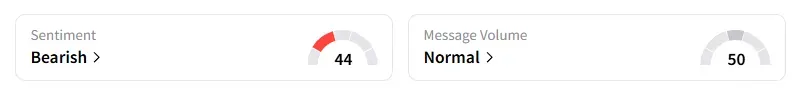

LTI Mindtree is all set to report Q2 earnings today. Data on Stocktwits showed that retail sentiment turned ‘bearish’ a day ago on this counter. It was ‘neutral’ last week.

LTI Mindtree shares are flat year-to-date (YTD).

Analyst Palak Jain has flagged breakouts in two stocks: Cholamandalam Investment and Persistent.

Cholamandalam Investment & Finance

Jain identified a cup and handle pattern breakout above a strong resistance zone with clear volume surge.

She added that Cholamandalam is a leading NBFC with consistent profit growth, strong asset quality, and an expanding loan book. The management’s focus on scale and digital platforms holds well for the outlook of the company.

Technical and fundamental alignment signal continuation of the long-term uptrend from this breakout, according to Jain. She recommended buying Cholamandalam above ₹1,699, with a stop loss at ₹1,529 for target prices of ₹1,750, ₹1,801, and ₹1,903.

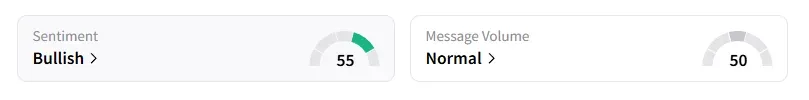

Data on Stocktwits showed that retail sentiment turned ‘bullish’ a day ago on this counter. It was ‘neutral’ last week.

Cholamandalam Finance shares have surged 40% year-to-date (YTD).

Persistent Systems

Jain noted a resistance breakout from a falling channel pattern with a volume spike, indicating renewed bullish momentum.

She added that Persistent has reported consistent revenue and profit growth, high client retention, and leadership in digital transformation services. Technical and fundamental trends align for a fresh swing move, with upside momentum confirmed above resistance.

Jain recommended buying Persistent above ₹5,726, with a stop loss at ₹5,152 for target prices of ₹5,897, ₹6,069, and ₹6,413.

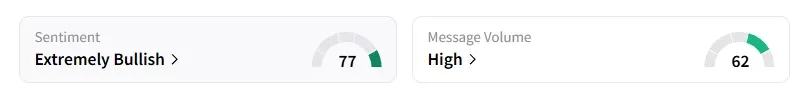

Data on Stocktwits showed that retail sentiment moved to ‘extremely bullish’ a day ago on this counter amid ‘high’ message volumes. This comes after a strong Q2 earnings report this week.

Persistent shares have declined 10% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)