Advertisement|Remove ads.

Bristol Myers Q4 Earnings Preview: Profits Under Pressure Even As Wall Street Bets On 2026 Pipeline

- Q4 revenue is expected to be largely flat at about $12.3 billion, while profitability is seen falling sharply quarter over quarter.

- Bristol Myers is leaning on newer drugs such as Reblozyl, Camzyos, and Breyanzi.

- Wall Street has turned more bullish, with multiple price target hikes over the past few weeks.

Bristol Myers Squibb Co. is set to report fourth-quarter (Q4) earnings on Thursday, with Wall Street consensus pointing to flat revenue growth and a decline in quarterly profitability.

BMY Q4 Earnings Preview

Revenue is estimated at $12.28 billion, up slightly from $12.22 billion previously, up 0.5% from the previous quarter. However, EBITDA is projected at $3.04 billion, down nearly 40% quarter over quarter, while EBIT is expected to fall about 28% to $2.93 billion, according to Koyfin analysts.

GAAP earnings per share (EPS) are expected at $0.98, down from $1.08, while adjusted EPS are forecast at $1.21, compared with $1.63 last quarter.

New BMY Launches Cushion Eliquis Patent Risk

In October, Bristol Myers lifted its full-year revenue outlook after newer medicines such as Reblozyl, Camzyos, and Breyanzi outperformed, helping offset slower growth from established blockbusters like Eliquis.

The drugmaker also said it's relying on its newer pipeline to offset Eliquis' 2028 patent cliff and continued to slash costs. Bristol said it would cut $3.5 billion in expenses through 2027, including layoffs and the elimination of various development programs.

BMY Pipeline Catalysts Ahead

Investors will also focus on key pipeline assets and partnerships. Data from Cobenfy in Alzheimer’s-related psychosis remain a closely watched catalyst after earlier trial disappointment, while Camzyos recently posted positive Phase 3 data in adolescents with hypertrophic cardiomyopathy.

In addition to organically growing its pipeline, Bristol has remained active in dealmaking across oncology and digital health. Deals include a licensing pact with Janux Therapeutics and a collaboration with Microsoft to use AI to detect lung cancer.

Wall Street Turns Bullish On BMY Ahead Of Q4 Earnings

Recently, several firms raised their price targets on BMY. Last week, Piper Sandler lifted its target to $66 from $62, implying an 18% upside from Tuesday’s close. The brokerage reiterating an ‘Overweight’ rating and pointed to improving pipeline visibility.

Last month, Citi raised its target to $60 from $53, maintaining a ‘Neutral’ stance, implying about 7% upside from last close, while adjusting expectations ahead of earnings season. It said estimates are "beatable" and that lower policy risk should create a favorable environment in 2026.

Leerink also lifted its price target to $60 from $54, reiterating an ‘Outperform’ rating and pointing to a catalyst-rich setup in 2026, implying a 7% upside from Tuesday’s close. Additionally, Scotiabank raised its target to $60 with a ‘Sector Perform’ rating, which also represents a 7% upside from current levels. UBS was more bullish, upgrading the stock to ‘Buy’ after assuming coverage and assigning a $65 price target, implying a 16% upside from the last close, citing improving sector fundamentals and rising investor confidence.

Koyfin data show 26 analysts covering the stock, with 8 combined ‘Buy’ and ‘Strong Buy’ ratings, 17 ‘Hold’ ratings, one ‘Sell’, and no ‘Strong Sell’ recommendations.

How Did Stocktwits Users React?

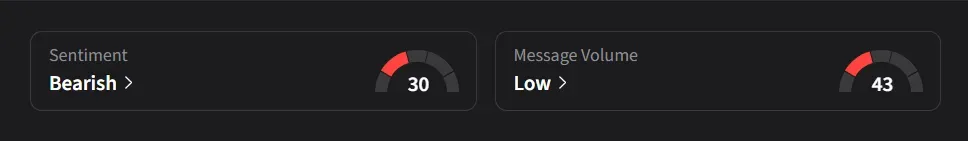

On Stocktwits, retail sentiment for BMY was ‘bearish’ amid ‘low’ message volume.

BMY’s stock has declined 2% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tinder_logo_resized_jpg_414770bfd6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_mike_novogratz_OG_jpg_66c648a5e8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2049058934_jpg_c3bac923f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_byd_song_plus_jpg_1c81de488f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_fiserv_logo_original_jpg_73be3dd4fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)