Advertisement|Remove ads.

Broadcom Stock Rips On Q1 Earnings Beat, Better-Than-Expected Guidance: Retail Turns Extremely Bullish

Shares of Broadcom Inc. (AVGO) surged nearly 13% in after-market trading on Thursday after the company’s first-quarter earnings blew past Wall Street estimates.

Broadcom reported earnings per share (EPS) of $1.60, surpassing expectations of $1.51 and rising from $1.10 that it reported during the same period a year earlier.

As for the topline, Broadcom’s Q1 revenue stood at $14.92 billion, significantly ahead of the estimated $14.59 billion and surging 25% year-on-year.

Broadcom’s two major segments—artificial intelligence and infrastructure software solutions—grew faster than the broader revenue. While AI revenue grew by a massive 77% YoY to $4.1 billion, the infrastructure segment’s revenue grew by 47% to $6.7 billion during this period.

Its free cash flow surged 28% on-year to $6 billion.

“We expect continued strength in AI semiconductor revenue of $4.4 billion in Q2, as hyperscale partners continue to invest in AI XPUs and connectivity solutions for AI data centers,” said Hock Tan, President and CEO of Broadcom.

Broadcom guided for Q2 revenue of $14.9 billion, representing a 19% surge from the prior year period.

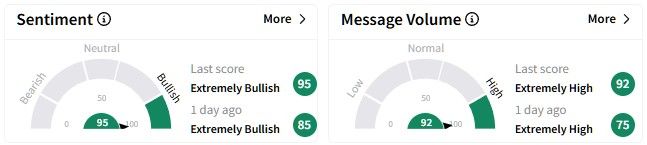

Retail sentiment on Stocktwits around the Broadcom stock turned ‘extremely bullish’ as investors appreciated the company’s blowout Q1 performance.

This is also reflected in the surge in message volumes, which skyrocketed more than 470% over the past 24 hours on the StockTwits platform.

One user expressed optimism that Broadcom’s performance will lift the broader Nasdaq index on Friday.

Another user mocked short sellers.

One user thinks Broadcom’s Q1 performance sets it up for another rally.

Broadcom’s stock has been on a downtrend recently, losing nearly 23% of its value year-to-date.

In contrast, over the past year, the stock has gained nearly 28%.

Data from FinChat shows the average price target for Broadcom is $246.58, implying an upside of more than 37%.

Of the 44 brokerage recommendations, there are 29 ‘Buy,’ seven ‘Outperform,’ and five ‘Hold’ ratings, while three brokerages have ‘No opinion’ on the stock.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)